Stay up-to-date.

Would you like these weekly financial recaps personally delivered to your email inbox? Sign up here:

Human-Centric Wealth Management™

Despite more than a year of aggressive Federal Reserve rate increases, the United States economy is still growing, albeit more slowly. U.S. gross domestic product (GDP) – the value of all goods and services produced in the U.S. economy – grew by 5.1 percent over the first quarter.

Over the first quarter of 2023, real GDP increased by 1.1 percent over the first quarter. In economics, “real” means the value of something after inflation (inflation is the rate at which prices are increasing). For example:

Last week, the Personal Consumption Expenditures (PCE) Index, which is one of the Federal Reserve’s preferred measures of price increases, showed that inflation has continued to trend lower.

Inflation and Fed rate hikes have had less impact on company earnings than analysts anticipated. To date, 53 percent of companies in the Standard & Poor’s 500 Index have reported results for the first quarter and almost 8 of 10 have reported that earnings per share was higher than expected. Overall, S&P 500 earnings are expected to dip in the first quarter before increasing later in 2023, reported John Butters of FactSet.

Last week, major U.S. stock indices finished the week higher, according to Nicholas Jasinski of Barron’s. Yields on U.S. Treasury notes and bonds moved lower last week.

Equities closed out April in strong form amid better-than-expected earnings and resilient economic data. The S&P 500 posted a gain of 1.6%, pushing its year-to-date gains to 9.2%. Not a bad way to start the first four months of the year, despite all the recession calls and the banking crisis of March.

However, sentiment remains bearish. Also, May presents one of the most well-known investment axioms: “Sell in May and go away.” This gets a ton of play in the media, as the next six months are indeed the worst-performing period of the year. Plus, stocks did quite poorly last year during this timeframe, which only adds to the hype.

The thinking is investors are better off ignoring these six months. The S&P 500 is typically weak May through October, up only 1.7% on average and higher less than 65% of the time, making it indeed the worst investing period on average.

The Bureau of Economic Analysis reported that the U.S. economy expanded by only 1.1% in the first quarter. That’s an annualized rate — the actual quarter-over-quarter increase is just under 0.3%. This was well below expectations for 1.9% growth.

GDP can be broken down into the following components:

The last two components are extremely volatile and can create significant swings in the headline data. Note that net exports are -3% of GDP because the U.S. exports less than it imports, and so net exports is negative.

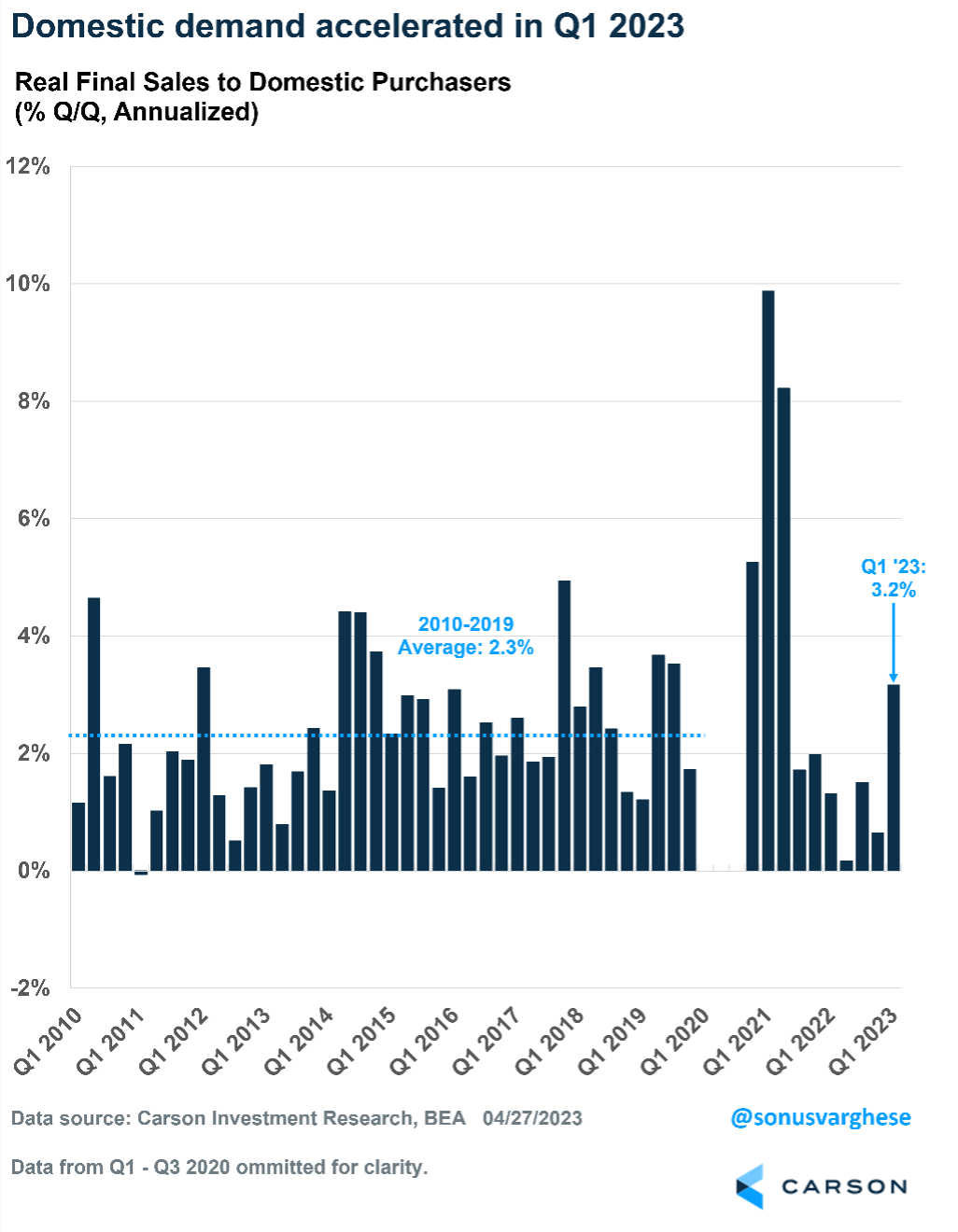

There Was No “Slowdown”

Domestic demand rose by 3.2% in the first quarter. That’s the fastest pace of growth since the second quarter of 2021. The average over the last decade (2010 – 2019) was 2.3%.

Domestic demand wasn’t boosted only by government spending, although this sector should not be ignored as it makes up close to a fifth of the economy.

Private sector demand rose 2.9% in the first quarter, which is the fastest pace since the second quarter of 2021.

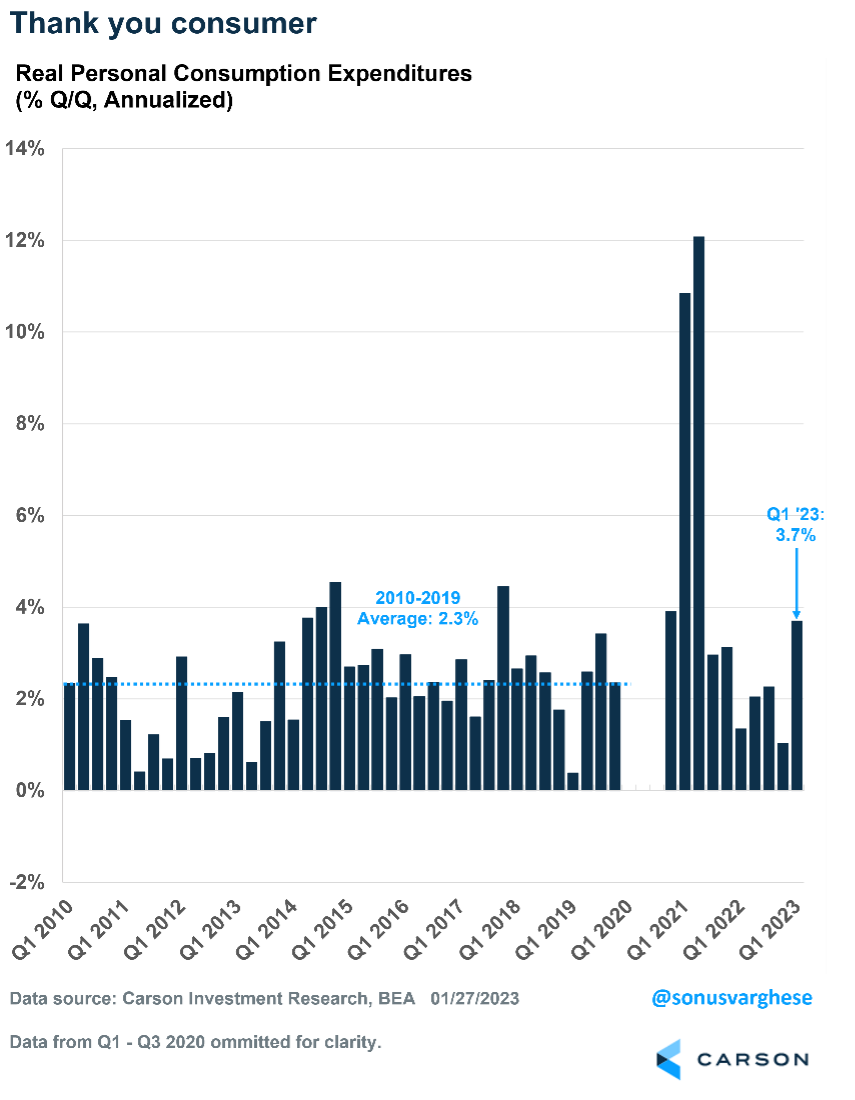

Consumers Are Powering the Economy

Domestic demand was boosted by personal consumption, which surged at a 3.7% pace. Much of this came from a rebound in goods consumption, mostly thanks to more vehicle purchases. But even services spending, which makes up 45% of the economy, rose 2.3%.

For perspective on the consumption numbers from the first quarter, the pace of growth was a lot faster than the 2.3% average experienced during the last decade and the fastest since the second quarter of 2021. However, consumption in 2021 was boosted by stimulus checks.

What’s driving strong consumption now?

What Next?

All the above data is for the first quarter, and we’re already a month into the second. It’s hard to imagine consumption and domestic demand growing at the torrid pace of the first quarter. However, for those predicting a recession it might be difficult to identify what could lead to a crash in employment or higher inflation going forward.

The latest employment news is positive. Initial claims for unemployment benefits dropped last week, from 246,000 to 230,000. This means fewer workers were laid off and filing for benefits. Even continuing claims, which represents the total number of people continuing to receive unemployment benefits, were unchanged at about 1.86 million.

Beyond the numbers, what matters is the trend, and there has not been a pickup in initial or continuing claims. In fact, the current levels are in line with those seen prior to the pandemic when employment was strong. Of course, with job growth already hitting 1 million plus in the first quarter, and the unemployment rate close to 50-plus-year lows, the labor market looks strong.

Another potential positive going forward: housing. Residential investment has dragged on GDP growth for eight straight quarters. There may be some relief coming from this sector, which would be positive for the economy.

Inflation is proving to be entrenched, and many have pointed to the tight labor market as the reason prices continue to rise. While labor costs are an important factor, there are other issues at play, too.

When the national news reports on a shock – the war in Ukraine affecting food supplies, the pandemic affecting supply chains, bird flu producing an egg shortage, or a dairy farm explosion affecting the price of milk – companies may take the opportunity to raise prices because customers are less likely to complain about the increase, reported Tracy Alloway and Joe Weisenthal of Bloomberg.

Companies in an industry, such as soft drink makers or chicken wing restaurants, may raise prices in tandem, giving consumers little choice but to pay the higher price. When the shock is resolved and wholesale prices move lower, companies often don’t lower retail prices. Instead, they simply keep prices high.

Isabella Weber and Evan Wasner at UMass Amherst listened to earnings calls, compiled data on companies, and reviewed literature about corporate price-setting. Their research paper reported that overlapping emergencies in recent years have allowed companies to increase prices and profits. They dubbed the phenomenon “sellers’ inflation.”

Sellers’ inflation is not possible in a perfectly competitive economy, but in a highly concentrated economy in which large firms are price makers, it is a real possibility – as we are witnessing again today.

Isabella Weber and Evan Wasner, UMass Amherst

Sellers’ inflation may be another reason inflation has been sticky.

In theory, a recession and falling consumer demand should cause companies to lower prices. However, as Weber and Wasner pointed out, recessions have the potential to hurt smaller businesses, if they have difficulty finding funding, and increase the power of larger ones.

May 5, 1961: Alan Shepard Becomes the First American in Space

On May 5, 1961, Navy Commander Alan Bartlett Shepard Jr. was launched into space aboard the Freedom 7 space capsule, becoming the first American astronaut to travel into space. The suborbital flight, which lasted 15 minutes and reached a height of 116 miles into the atmosphere, was a major triumph for the National Aeronautics and Space Administration (NASA).

In the late 1950s and early 1960s, the United States and Soviet Union raced to become the first country to put a man in space and return him to Earth. On April 12, 1961, the Soviet space program won the race when cosmonaut Yuri Gagarin was launched into space, put in orbit around the planet, and safely returned to Earth. One month later, Shepard’s suborbital flight restored faith in the U.S. space program.

NASA continued to trail the Soviets closely until the late 1960s and the successes of the Apollo lunar program. In July 1969, the Americans took a giant leap forward with Apollo 11, a three-stage spacecraft that took U.S. astronauts to the surface of the moon and returned them to Earth. On February 5, 1971, Alan Shepard, the first American in space, became the fifth astronaut to walk on the moon as part of the Apollo 14 lunar landing mission.

Character is like a tree and reputation like a shadow. The shadow is what we think of it; the tree is the real thing.

Abraham Lincoln, Former U.S. President

Life is what happens when you’re busy making other plans.

John Lennon, Musician

Investment advisory services offered through SPC Financial® (SPC). *Tax services and analysis are provided by the related firm, Sella & Martinic (S&M), through a separate engagement letter with clients. SPC and S&M do not accept orders and/or instructions regarding your investment account by email, voicemail, fax or any alternative method. Transactional details do not supersede normal trade confirmations or statements.

Email through the Internet is not secure or confidential. SPC and S&M reserve the right to monitor all email. Any information provided in this message has been prepared from sources believed to be reliable, but is not guaranteed by SPC or S&M, their owners or employees, and is not a complete summary or statement of all available data necessary for making a financial decision.

Any information provided is for informational purposes only and does not constitute a recommendation. SPC and S&M, including their owners or employees may own securities mentioned in this email or options, rights, or warrants to purchase or sell these securities.

SPC does not provide tax or legal advice. Before making a legal, investment, or tax decision, contact the appropriate professional. Any tax information or advice contained in this message is confidential and subject to the Accountant/Client Privilege.

This email is intended only for the person or entity to which it is addressed and may contain confidential and/or privileged material. Any review, retransmission, dissemination, or other use of, or taking of any action in reliance upon, this information by persons or entities other than the intended recipient is prohibited. If you received this message in error, please notify the sender and delete the material from your computer immediately. SPC and S&M shall not be liable for the improper or incomplete transmission of the information contained in this communication or for any delay in its receipt or damage to your system.

Portions of this newsletter were prepared by Carson Group Coaching. Carson Group Coaching is not affiliated with SPC or S&M. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. This information is not intended as a solicitation of an offer to buy, hold, or sell any security referred to herein. There is no assurance any of the trends mentioned will continue in the future.

Any expression of opinion is as of this date and is subject to change without notice. Opinions expressed are not intended as investment advice or to predict future performance. Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful. Past performance does not guarantee future results. Investing involves risk, including loss of principal. Consult your financial professional before making any investment decision. Stock investing involves risk including loss of principal. Diversification and asset allocation do not ensure a profit or guarantee against loss. There is no assurance that any investment strategy will be successful.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. The Dow Jones Industrial Average (DJIA), commonly known as "The Dow" is an index used to measure the daily stock price movements of 30 large, publicly owned U.S. companies. The NASDAQ composite is an unmanaged index of securities traded on the NASDAQ system.

The MSCI ACWI (All Country World Index) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. As of June 2007, the MSCI ACWI consisted of 48 country indices comprising 23 developed and 25 emerging market country indices. Bond prices and yields are subject to change based upon market conditions and availability. If bonds are sold prior to maturity, you may receive more or less than your initial investment. There is an inverse relationship between interest rate movements and fixed income prices. Generally, when interest rates rise, fixed income prices fall and when interest rates fall, fixed income prices rise.

The Bloomberg Barclays US Aggregate Bond Index is a market capitalization-weighted index, meaning the securities in the index are weighted according to the market size of each bond type. Most U.S. traded investment grade bonds are represented.

Please note, direct investment in any index is not possible. Sector investments are companies engaged in business related to a specific sector. They are subject to fierce competition and their products and services may be subject to rapid obsolescence. There are additional risks associated with investing in an individual sector, including limited diversification.

Third-party links are being provided for informational purposes only. SPC and S&M are not affiliated with and do not endorse, authorize, sponsor, verify or monitor any of the listed websites or their respective sponsors, and they are not responsible or liable for the content of any website, or the collection or use of information regarding any website's users and/or members. Links are believed to be accurate at time of dissemination, but we make no guarantee, expressed or implied, to the accuracy of the links subsequently.

This may constitute a commercial email message under the CAN-SPAM Act of 2003. If you do not wish to receive marketing or advertising related email messages from us, please click the “unsubscribe” link within this email message. You will continue to receive emails from us related to servicing your account(s).

Sources:

https://www.bea.gov/sites/default/files/2023-04/gdp1q23_adv.pdf

https://www.reuters.com/markets/us/strong-us-consumer-spending-seen-driving-economy-first-quarter-2023-04-27

https://www.econlib.org/library/Topics/HighSchool/RealvsNominal.html

https://www.bea.gov/news/2023/personal-income-and-outlays-march-2023

https://insight.factset.com/sp-500-earnings-season-update-april-28-2023

https://www.history.com/this-day-in-history/the-first-american-in-space

https://www.barrons.com/articles/stock-market-volatility-tech-risk-6cf00fe0?refsec=the-trader&mod=topics_the-trader

https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value_month=202304

https://www.carsonwealth.com/insights/blog/market-commentary-market-rally-to-close-april-but-be-wary-of-sell-in-may/?utm_source=sfmc&utm_medium=email&utm_campaign=weekly-market-commentary&j=2211231&sfmc_sub=110820205&l=380_HTML&u=30963304&mid=100016897&jb=2003

https://www.bloomberg.com/news/articles/2023-03-09/how-excuseflation-is-keeping-prices-and-corporate-profits-high

https://scholarworks.umass.edu/cgi/viewcontent.cgi?article=1348&context=econ_workingpaper

https://www.brainyquote.com/quotes/abraham_lincoln_121094

Would you like these weekly financial recaps personally delivered to your email inbox? Sign up here: