Stay up-to-date.

Would you like these weekly financial recaps personally delivered to your email inbox? Sign up here:

Human-Centric Wealth Management™

Stocks and bonds are two of the better-known asset classes in the family of potential investments. Last week, they were in opposition.

Bond yields have been moving higher in anticipation of the Federal Reserve raising rates again. For a while last week, every maturity of Treasury – from the 1-month Treasury bill to the 30-year Treasury bond – boasted a yield above 4 percent. Some shorter-maturity Treasuries yielded more than 5 percent.

When bond rates move higher, borrowing becomes more expensive for companies. As the cost of doing business rises, the outlook for company earnings tends to moderate, pushing stock prices lower. (Companies in the financial industry are often an exception because financial companies often benefit from higher rates.)

In addition, higher bond yields may lead to lower stock prices as investors who seek income, and prefer to take less risk, move some assets from stocks to bonds. For example, more conservative investors who have held dividend-paying stocks to help achieve retirement income goals might choose to move some assets into bonds.

Rising Treasury yields can make stocks less appealing because they allow investors to park money in instruments that now earn an attractive return…investment grade bonds saw inflows for 10 consecutive weeks…the longest streak since October.

Isabel Wang, Morningstar

Like a younger sibling who refuses to follow the lead of an older brother or sister, stock markets ignored rising bond rates last week. It’s difficult to know which one is on the right track, which makes being selective more important.

This is no longer a black-and-white, buy-or-sell stock market. The era of ‘There is no alternative’ (TINA) to growth-oriented tech stocks is in the rearview mirror, and both stocks and bonds offer compelling opportunities, if you pick the right ones.

Carleton English, Barron’s

Major U.S. stock indices finished higher, ending a three-week losing streak.

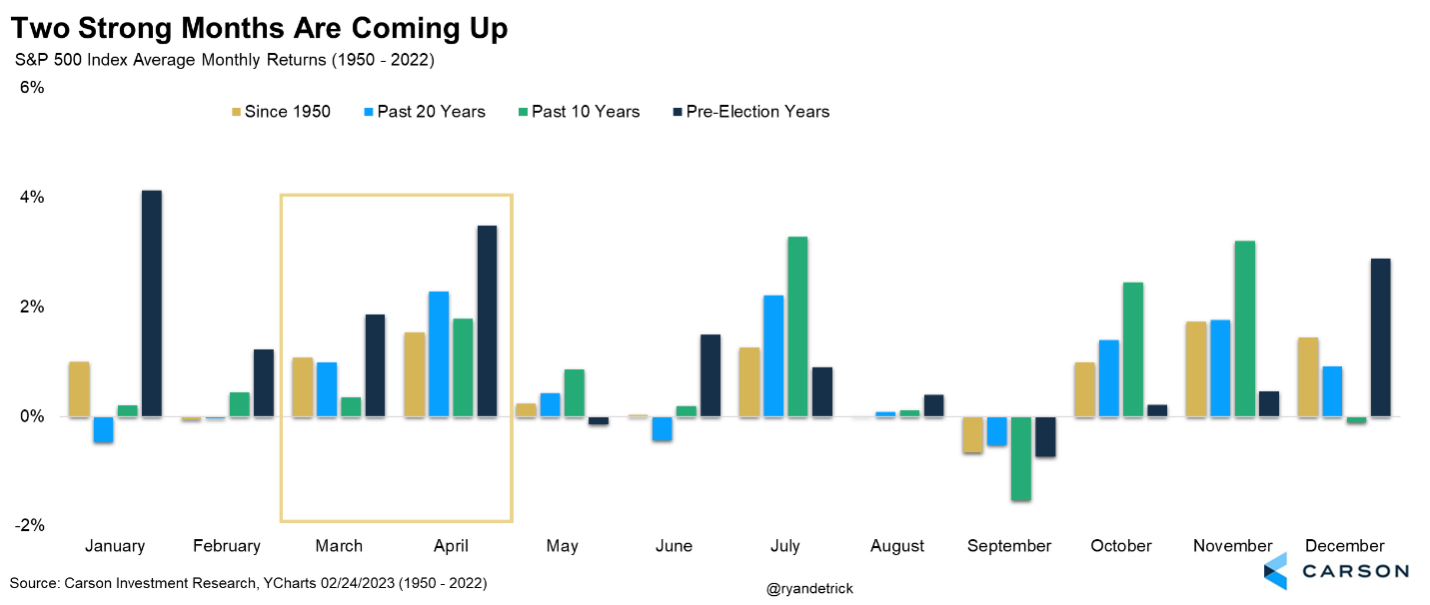

After the nearly 17% rally off the October lows into mid-February, some type of hangover or indigestion made sense. March and April are historically two of the strongest months of the year, but they do even better in pre-election years. Since 1950, the S&P 500 has gained 1.1% in March, while April has been up 1.5%. But in a pre-election year those returns go to 1.9% and 3.5%, respectively.

Three-month Treasury bills, the best proxy for a liquid and “risk-free” asset, currently yields about 4.9%, while 10-year Treasury notes yield around 4%. These yields are tempting, more so because we haven’t seen rates this high in 15 years.

Consider stocks on the other hand. And instead of dividend yields, compare earnings yields. Earnings yields that are corrected for cyclical effects are good predictors of long-run real returns for stocks (more on the “real” part below). If a company paid out all earnings as dividends, then the earnings yield would equal the dividend yield.

Earnings yield is basically the inverse of the price-to-earnings ratio, and there are myriad approaches to estimating earnings. For example, if a stock is trading at $100 and its expected earnings per share over the next 12 months is $5, it has a forward P/E ratio of 20. And an earnings yield of 5/100 = 5%, meaning every dollar invested in the stock would yield 5 cents.

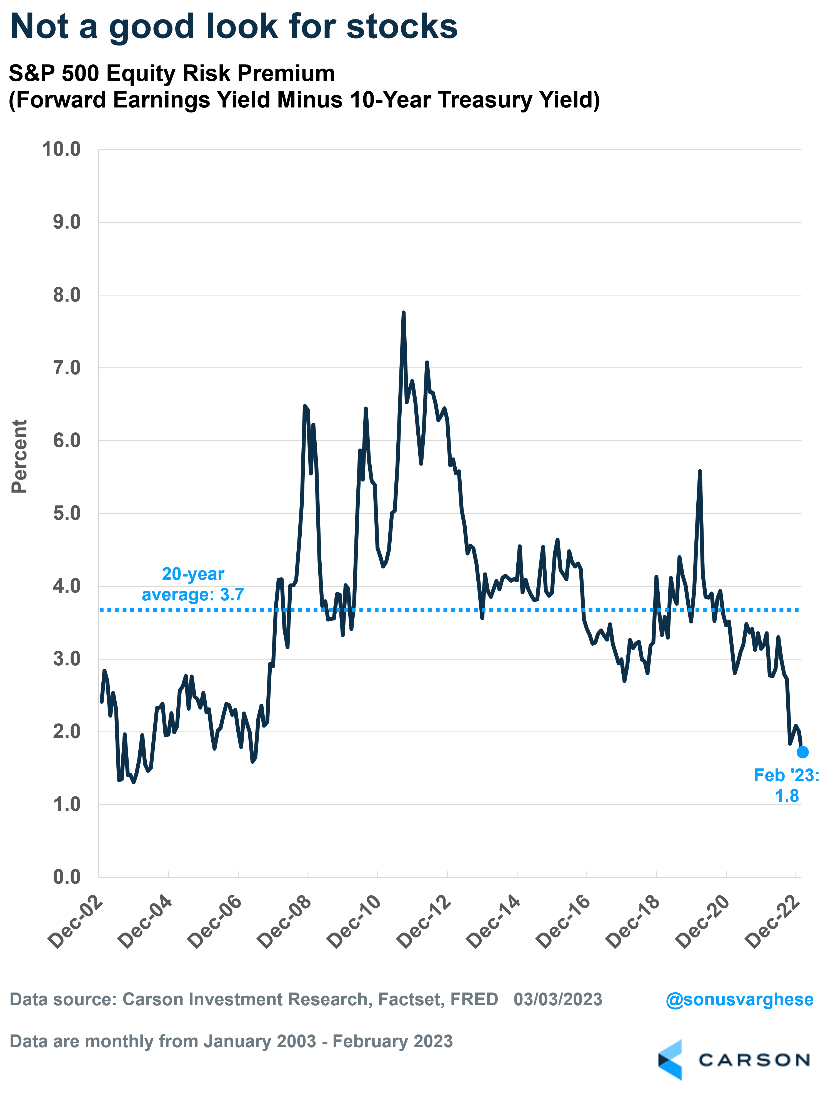

At the end of 2019, the S&P 500 was trading with a forward P/E of 18.5, i.e., with an earnings yield of 5.4%. That was pretty good considering that 10-year Treasuries were yielding about 1.7%. It implied an equity risk premium (ERP) of about 3.4%. ERP is the excess return investors require to hold risky assets such as stocks.

Right now, the S&P 500 is trading at a forward P/E of 17.5, which translates to an earnings yield of 5.7% and is a tad better than the pre-pandemic yield. The problem is that with 10-year Treasury yields around 4%, the implied ERP has seen a sharp compression, as the chart below shows.

That gets to the question: Why should I invest in stocks when risk-free yields are so high?

Not a Great Timing Tool

The ERP as calculated above is not a great indicator of future returns, let alone a timing tool that indicates when to hold stocks and when to shift to bonds. The last time the premium was as low as it is currently was in June 2007, when it was 1.6%.

In any case, this approach to calculate the ERP has its faults. Like any indicator, it illustrates one of many points that deserve consideration.

Stocks are Real Assets

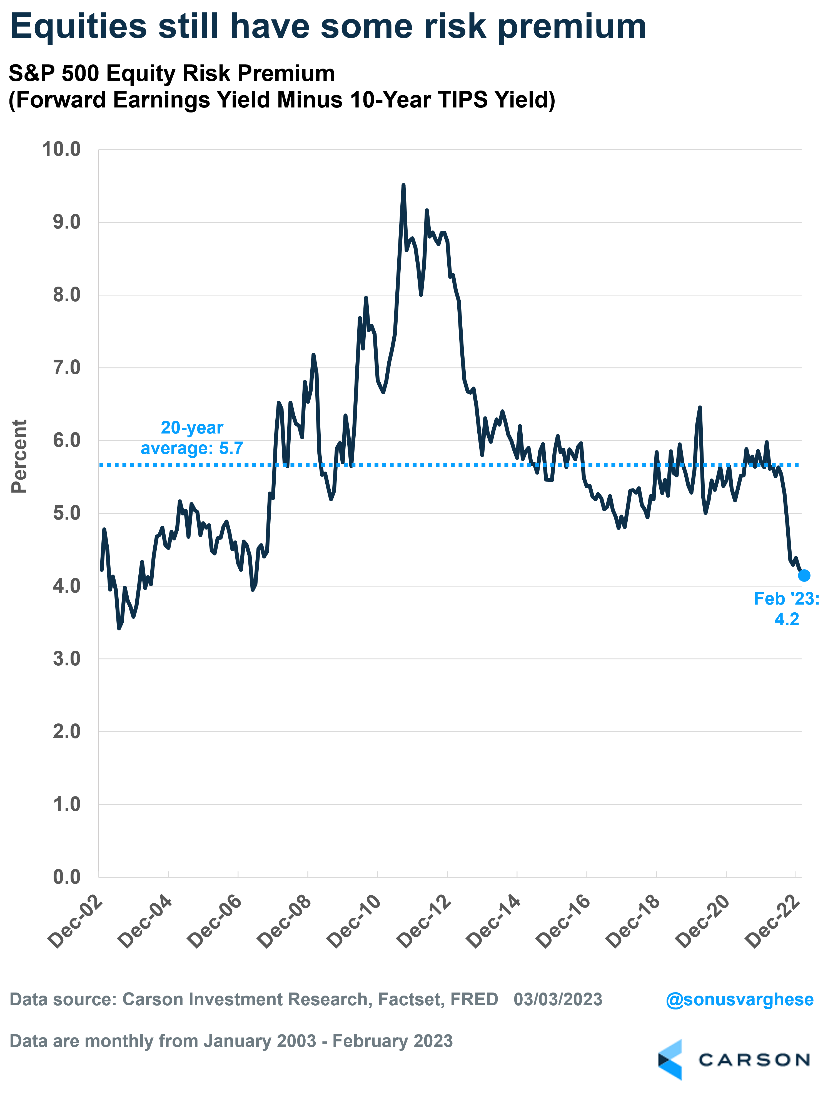

One problem with the above approach for calculating the ERP is that stocks are real assets whose prices rise with inflation. Also, corporate earnings move higher with inflation since companies can pass along rising input costs over time to their customers.

The picture looks a little better with that comparison, although the ERP using this approach is still lower than what it was pre-pandemic. That is because real risk-free yields, as measured by inflation-indexed Treasury bonds, have climbed sharply since then. The 10-year real yield was close to zero at the end of 2019 and fell as low as -1.2% in August 2021. The Fed’s aggressive rate hikes resulted in a dramatic upward shift in 2022, with the 10-year real yield currently around 1.6%.

The chart below shows ERP estimated using real yields. It’s fallen to 4.2%, but that’s still some serious premium.

So, don’t ignore stocks.

If you’re worried about the possibility of dementia, make sure you’re topped up with vitamin D. That’s the finding of an ongoing study from the University of Calgary’s Brain Institute in Canada, the University of Exeter in the United Kingdom, and the U.S. National Alzheimer’s Coordinating Center.

More than 12,000 people participated in the study. The average age of participants was 71, and none had dementia when the study began. Slightly more than one-third of participants received vitamin D supplements. Researchers noted:

“…taking vitamin D was associated with living dementia-free for longer, and they also found 40 percent fewer dementia diagnoses in the group who took supplements…While Vitamin D was effective in all groups, the team found that effects were significantly greater in females, compared to males. Similarly, effects were greater in people with normal cognition, compared to those who reported signs of mild cognitive impairment – changes to cognition which have been linked to a higher risk of dementia.”

Vitamin D is known as the sunshine vitamin. When you walk outside on a sunny day, ultraviolet rays from the sun interact with chemicals in your skin to produce the vitamin. The amount you produce depends on a variety of factors, including where you live, the time of day you’re outside, and your pigmentation, reported the Mayo Clinic.

About one billion people around the world are deficient in vitamin D. That number includes about 35 percent of the U.S. population. In the U.S., people who are older than age 65 and people who have darker skin are more likely to experience vitamin D deficits, according to the Cleveland Clinic.

Having too little Vitamin D can be a significant health issue because it may play a role in preventing cancer, multiple sclerosis, psoriasis, bone softness, muscle weakness, and osteoporosis. As people become more aware of the importance of vitamin D, the market for supplements is expected to grow.

The deadline to make 2022 contributions to your IRA or Roth IRA is April 18, 2023. The total contributions that you can make annually to these accounts cannot be more than the following:

If you have already contributed the maximum amount allowed for 2022, the total contributions that can be made in 2023 are:

If you are unsure of how much you have contributed to your IRA or Roth IRA for the year 2022, or would like assistance in opening one of these accounts, please contact us.

March 7, 1876: Alexander Graham Bell Patents the Telephone

On March 7, 1876, 29-year-old Alexander Graham Bell received a patent for his revolutionary new invention: the telephone.

The Scottish-born Bell worked in London with his father, Melville Bell, who developed Visible Speech, a written system used to teach speaking to the deaf. In the 1870s, the Bells moved to Boston, Massachusetts, where the younger Bell found work as a teacher at the Pemberton Avenue School for the Deaf.

While in Boston, Bell became very interested in the possibility of transmitting speech over wires. Samuel F.B. Morse’s invention of the telegraph in 1843 had made nearly instantaneous communication possible between two distant points. The drawback of the telegraph, however, was that it still required hand-delivery of messages between telegraph stations and recipients, and only one message could be transmitted at a time. Bell wanted to improve on this by creating a “harmonic telegraph,” a device that combined aspects of the telegraph and record player to allow individuals to speak to each other from a distance.

With the help of Thomas A. Watson, a Boston machine shop employee, Bell developed a prototype. In this first telephone, sound waves caused an electric current to vary in intensity and frequency, causing a thin, soft iron plate–called the diaphragm–to vibrate. These vibrations were transferred magnetically to another wire connected to a diaphragm in another, distant instrument. When that diaphragm vibrated, the original sound would be replicated in the ear of the receiving instrument. Three days after filing the patent, the telephone carried its first intelligible message, the famous “Mr. Watson, come here, I need you” from Bell to his assistant.

You only live once, but if you do it right, once is enough.

Mae West, Actress

Horror films don’t create fear, they release it.

Wes Craven, Film Director

Investment advisory services offered through SPC Financial® (SPC). *Tax services and analysis are provided by the related firm, Sella & Martinic (S&M), through a separate engagement letter with clients. SPC and S&M do not accept orders and/or instructions regarding your investment account by email, voicemail, fax or any alternative method. Transactional details do not supersede normal trade confirmations or statements.

Email through the Internet is not secure or confidential. SPC and S&M reserve the right to monitor all email. Any information provided in this message has been prepared from sources believed to be reliable, but is not guaranteed by SPC or S&M, their owners or employees, and is not a complete summary or statement of all available data necessary for making a financial decision.

Any information provided is for informational purposes only and does not constitute a recommendation. SPC and S&M, including their owners or employees may own securities mentioned in this email or options, rights, or warrants to purchase or sell these securities.

SPC does not provide tax or legal advice. Before making a legal, investment, or tax decision, contact the appropriate professional. Any tax information or advice contained in this message is confidential and subject to the Accountant/Client Privilege.

This email is intended only for the person or entity to which it is addressed and may contain confidential and/or privileged material. Any review, retransmission, dissemination, or other use of, or taking of any action in reliance upon, this information by persons or entities other than the intended recipient is prohibited. If you received this message in error, please notify the sender and delete the material from your computer immediately. SPC and S&M shall not be liable for the improper or incomplete transmission of the information contained in this communication or for any delay in its receipt or damage to your system.

Portions of this newsletter were prepared by Carson Group Coaching. Carson Group Coaching is not affiliated with SPC or S&M. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. This information is not intended as a solicitation of an offer to buy, hold, or sell any security referred to herein. There is no assurance any of the trends mentioned will continue in the future.

Any expression of opinion is as of this date and is subject to change without notice. Opinions expressed are not intended as investment advice or to predict future performance. Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful. Past performance does not guarantee future results. Investing involves risk, including loss of principal. Consult your financial professional before making any investment decision. Stock investing involves risk including loss of principal. Diversification and asset allocation do not ensure a profit or guarantee against loss. There is no assurance that any investment strategy will be successful.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. The Dow Jones Industrial Average (DJIA), commonly known as "The Dow" is an index used to measure the daily stock price movements of 30 large, publicly owned U.S. companies. The NASDAQ composite is an unmanaged index of securities traded on the NASDAQ system.

The MSCI ACWI (All Country World Index) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. As of June 2007, the MSCI ACWI consisted of 48 country indices comprising 23 developed and 25 emerging market country indices. Bond prices and yields are subject to change based upon market conditions and availability. If bonds are sold prior to maturity, you may receive more or less than your initial investment. There is an inverse relationship between interest rate movements and fixed income prices. Generally, when interest rates rise, fixed income prices fall and when interest rates fall, fixed income prices rise.

The Bloomberg Barclays US Aggregate Bond Index is a market capitalization-weighted index, meaning the securities in the index are weighted according to the market size of each bond type. Most U.S. traded investment grade bonds are represented.

Please note, direct investment in any index is not possible. Sector investments are companies engaged in business related to a specific sector. They are subject to fierce competition and their products and services may be subject to rapid obsolescence. There are additional risks associated with investing in an individual sector, including limited diversification.

Third-party links are being provided for informational purposes only. SPC and S&M are not affiliated with and do not endorse, authorize, sponsor, verify or monitor any of the listed websites or their respective sponsors, and they are not responsible or liable for the content of any website, or the collection or use of information regarding any website's users and/or members. Links are believed to be accurate at time of dissemination, but we make no guarantee, expressed or implied, to the accuracy of the links subsequently.

This may constitute a commercial email message under the CAN-SPAM Act of 2003. If you do not wish to receive marketing or advertising related email messages from us, please click the “unsubscribe” link within this email message. You will continue to receive emails from us related to servicing your account(s).

Sources:

https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value_month=202303

https://www.investopedia.com/articles/stocks/09/how-interest-rates-affect-markets.asp

https://www.morningstar.com/news/marketwatch/20230303635/data-shows-investors-running-toward-safety-of-cash-as-stock-market-stumbles-yields-rise

https://www.history.com/this-day-in-history/alexander-graham-bell-patents-the-telephone

https://www.barrons.com/articles/how-the-planets-aligned-for-the-stock-market-and-ended-a-weekslong-losing-streak-253c4a1a?refsec=the-trader&mod=topics_the-trader

https://www.carsonwealth.com/insights/market-commentary/market-commentary-the-hangover-ends/

https://news.exeter.ac.uk/research/taking-vitamin-d-could-help-prevent-dementia-study-finds/

https://www.mayoclinic.org/drugs-supplements-vitamin-d/art-20363792

https://www.globenewswire.com/news-release/2023/01/12/2588210/0/en/the-global-vitamin-d-market-is-expected-to-grow-at-a-cagr-of-8-49-during-2022-2027.html

https://my.clevelandclinic.org/health/diseases/15050-vitamin-d-vitamin-d-deficiency

https://www.brainyquote.com/search_results?x=0&y=0&q=health

Would you like these weekly financial recaps personally delivered to your email inbox? Sign up here: