Stay up-to-date.

Would you like these weekly financial recaps personally delivered to your email inbox? Sign up here:

Human-Centric Wealth Management™

Financial markets were volatile last week as investors parsed the risks around bank closures, central banks offered additional protections for depositors, and regulators took a harder look at bank balance sheets.

For much of last year, volatility was elevated, but the risks were somewhat ‘known’ (chiefly inflation and recession)…Now, the introduction of the banking crisis has created a new unknown, which could ultimately mean a sharper increase in volatility (if worse than expected) or a quick reprieve (if fears prove unfounded).

Nicholas Jasinski, Barron’s

Unknown risks create uncertainty, and you know what they say about markets and uncertainty.

Yields on Treasuries dropped sharply as investors sought opportunities they perceived to be safe, reported Lawrence C. Strauss of Barron’s. The yield on the two-year U.S. Treasury dropped from 4.6 percent to 3.8 percent, and the yield on the 30-year U.S. Treasury fell from 3.7 percent to 3.6 percent.

While Treasuries are considered to be quite safe, one lesson from recent events is that there are circumstances in which even safe-haven investments may produce a loss. For example, in general, bonds expose investors to interest-rate risk. When interest rates rise, the value of bonds falls. If a bondholder must sell a bond before it matures, the seller may realize a loss.

In stock markets, bearish sentiment was high. Almost half (48.4 percent) of participants in the AAII Survey of Investor Sentiment were bearish. That’s well above the historic average of 31.0 percent. In contrast, just about one-fifth (19.2 percent) were bullish. That’s well below the historic average, which is 37.5 percent. The Survey of Investor Sentiment is widely considered to be a contrarian indicator and, in general, the market moves in opposition to contrarian indicators.

Despite investor pessimism, the Standard & Poor’s 500 Index and Nasdaq Composite finished the week higher, while the Dow Jones Industrial Average finished slightly lower.

On the heels of the first three bank failures in years, issues spread across the pond last week as Credit Suisse Group AG became the latest banking institution to make headlines over solvency concerns. This Swiss bank was a three-dollar stock two weeks ago and has long been a laggard, down more than 90% from its all-time high, even before the trouble started to brew. Our main question: Are Credit Suisse’s challenges really a surprise?

The three banks that went under last week are two crypto-heavy institutions and Silicon Valley Bank, which loaned money to tech and startup companies. By no means are these traditional banks, and many other larger U.S. banks are in solid financial shape. Once rates rose and tech slowed, the issues piled up for Silicon Valley Bank and the company filed for Chapter 11 bankruptcy.

To help restore confidence in banks, the Federal Reserve, FDIC, and U.S. Treasury Department pledged that all SVB depositors will be fully backstopped and other banks can obtain financing through a new Bank Term Funding Program (BTFP). The price of many small banks fell last week, but the large banks held up much better.

The Saudi National Bank said it would not buy any more shares or provide additional financial assistance to Credit Suisse. Since it is the largest shareholder, shares fell another 24%. While credit default swaps linked to Credit Suisse’s bonds hit all-time highs around the middle of the week, other European banks’ credit default spreads moved higher but not to new highs. Think of credit default swaps as the price of insurance against potential losses. A high number indicates worry is increasing about a bank’s solvency.

Swiss regulators and the Swiss National Bank offered Credit Suisse a $54 billion line of credit to help stem the initial worries. Over the weekend it was announced that UBS Group would buy Credit Suisse thanks to “substantial liquidity assistance” from the Swiss National Bank. The deal is for approximately $3 billion, with the Swiss government providing 9 billion Swiss francs to backstop potential losses.

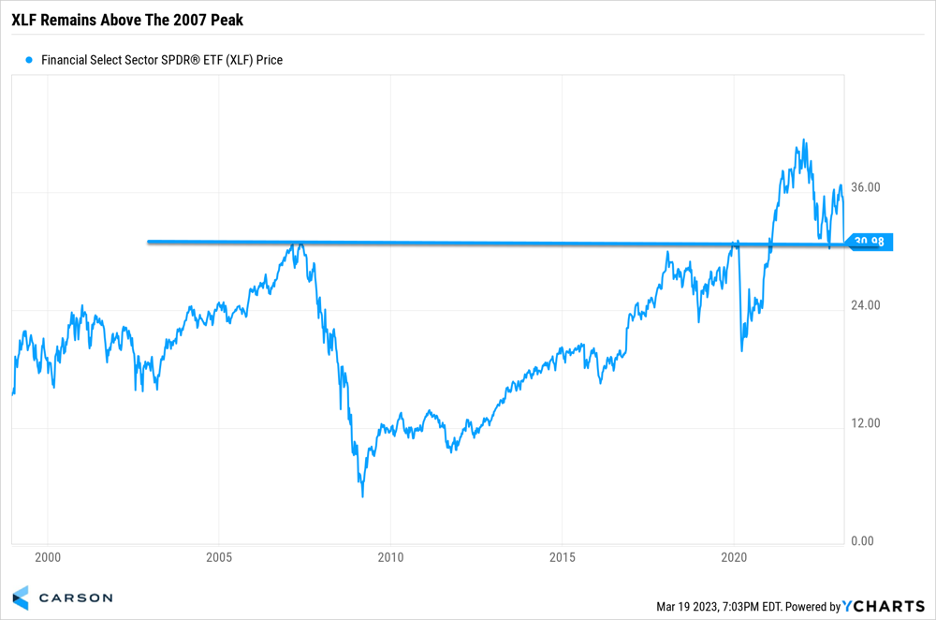

The bottom line is the banking crisis is not over yet. Money is flowing from small banks to large banks, and large banks are in solid financial shape. Lastly, the Financial Select Sector SPDR ETF remains above the 2007 peak. As shown below, this could be one of the most important charts in the world. Should it significantly break the 30 level more trouble could be coming. As of now, it remains above this critical point.

In the face of a major crisis, banks gained last week, with the S&P 500 up 1.5% and the tech-heavy Nasdaq up 4.4%. In fact, it was one of the largest weekly outperformances for the Nasdaq versus the Dow since the early 2000s.

A large drop in yields and lowered expectations about the Fed being ultra-aggressive drove the stocks’ bounce. At the same time, fear jumped to levels consistent with major market lows. In other words, those stockholders who wanted to sell, have sold. The American Association of Individual Investors (AAII) bulls were beneath 20% for the first time since September 2022, while bears were at the highest level they’ve been this year.

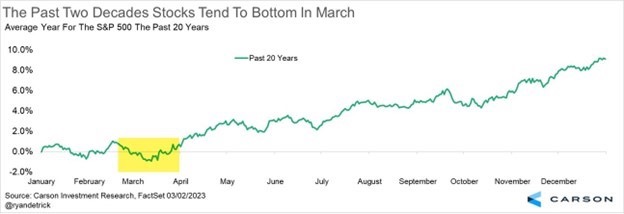

March is well-known for major market lows and volatility. March hit major lows in 2003, 2009, and 2020, amidst negative headlines and sentiment. In fact, over the past 20 years stocks have bottomed in March, as the chart below shows.

While the first half of March is often dicey, the second half of the month tends to see more green. Better times could be ahead if history is a guide.

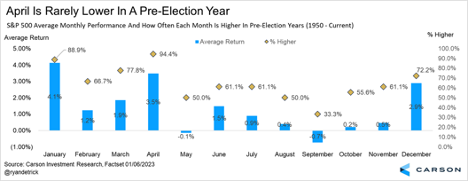

Lastly, stocks in April during a pre-election year tend to do quite well, up 3.5% on average. But the amazing part is they’ve been higher 17 of the past 18 years, up more than 94% of the time. Yet another reason to believe a spring rally is quite possible.

The deadline to make 2022 contributions to your IRA or Roth IRA is April 18, 2023. The total contributions that you can make annually to these accounts cannot be more than the following:

If you have already contributed the maximum amount allowed for 2022, the total contributions that can be made in 2023 are:

If you are unsure of how much you have contributed to your IRA or Roth IRA for the year 2022, or would like assistance in opening one of these accounts, please contact us.

March 22, 1934: First Masters Golf Tournament Begins

On March 22, 1934, the first Masters golf championships teed off in Augusta, Georgia. The Augusta National Golf Club course presents difficulties for many of the golfers, but Emmet French, Jimmy Hines and Horton Smith finish under par and share the lead after shooting 70, two under par, in the first of four rounds.

Smith would go on to win the tournament, finishing four under par with scores of 70-72-70-72. Craig Wood (-3), Paul Runyan (-2) and Billy Burke (-2) were the only other golfers to finish under par.

Smith was a big fan of the course, telling the press: "There is nothing monotonous about that course, and it is one of the most beautiful I ever played. Each one of the holes presents something new." Smith would go onto win the 1936 Masters as well, cementing his Hall of Fame golf career.

While Smith’s performance at the Masters was impressive, much of the coverage was focused on Bobby Jones, the man who founded and helped design golf’s most famous course. Four years earlier, Jones had reached golf’s apex when he became the first to achieve a Grand Slam by winning all four major tournaments in the same year: the British Open, U.S. Open and the British and U.S. amateur championships. He won 13 major championships from 1923-30.

Despite his historic accomplishments, Jones struggled in his inaugural round at the Masters, especially on the greens. He putted 36 times, including three three-putts, on his way to a 76 (+4). Although he improved upon that first round with subsequent rounds of 74-72-72, Jones finished tied for 13th, 10 shots behind Smith.

Happiness is the absence of striving for happiness.

Zhuang Zhou, Chinese Philosopher

Comparison is the thief of joy.

Theodore Roosevelt, 26th President of the United States

Investment advisory services offered through SPC Financial® (SPC). *Tax services and analysis are provided by the related firm, Sella & Martinic (S&M), through a separate engagement letter with clients. SPC and S&M do not accept orders and/or instructions regarding your investment account by email, voicemail, fax or any alternative method. Transactional details do not supersede normal trade confirmations or statements.

Email through the Internet is not secure or confidential. SPC and S&M reserve the right to monitor all email. Any information provided in this message has been prepared from sources believed to be reliable, but is not guaranteed by SPC or S&M, their owners or employees, and is not a complete summary or statement of all available data necessary for making a financial decision.

Any information provided is for informational purposes only and does not constitute a recommendation. SPC and S&M, including their owners or employees may own securities mentioned in this email or options, rights, or warrants to purchase or sell these securities.

SPC does not provide tax or legal advice. Before making a legal, investment, or tax decision, contact the appropriate professional. Any tax information or advice contained in this message is confidential and subject to the Accountant/Client Privilege.

This email is intended only for the person or entity to which it is addressed and may contain confidential and/or privileged material. Any review, retransmission, dissemination, or other use of, or taking of any action in reliance upon, this information by persons or entities other than the intended recipient is prohibited. If you received this message in error, please notify the sender and delete the material from your computer immediately. SPC and S&M shall not be liable for the improper or incomplete transmission of the information contained in this communication or for any delay in its receipt or damage to your system.

Portions of this newsletter were prepared by Carson Group Coaching. Carson Group Coaching is not affiliated with SPC or S&M. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. This information is not intended as a solicitation of an offer to buy, hold, or sell any security referred to herein. There is no assurance any of the trends mentioned will continue in the future.

Any expression of opinion is as of this date and is subject to change without notice. Opinions expressed are not intended as investment advice or to predict future performance. Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful. Past performance does not guarantee future results. Investing involves risk, including loss of principal. Consult your financial professional before making any investment decision. Stock investing involves risk including loss of principal. Diversification and asset allocation do not ensure a profit or guarantee against loss. There is no assurance that any investment strategy will be successful.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. The Dow Jones Industrial Average (DJIA), commonly known as "The Dow" is an index used to measure the daily stock price movements of 30 large, publicly owned U.S. companies. The NASDAQ composite is an unmanaged index of securities traded on the NASDAQ system.

The MSCI ACWI (All Country World Index) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. As of June 2007, the MSCI ACWI consisted of 48 country indices comprising 23 developed and 25 emerging market country indices. Bond prices and yields are subject to change based upon market conditions and availability. If bonds are sold prior to maturity, you may receive more or less than your initial investment. There is an inverse relationship between interest rate movements and fixed income prices. Generally, when interest rates rise, fixed income prices fall and when interest rates fall, fixed income prices rise.

The Bloomberg Barclays US Aggregate Bond Index is a market capitalization-weighted index, meaning the securities in the index are weighted according to the market size of each bond type. Most U.S. traded investment grade bonds are represented.

Please note, direct investment in any index is not possible. Sector investments are companies engaged in business related to a specific sector. They are subject to fierce competition and their products and services may be subject to rapid obsolescence. There are additional risks associated with investing in an individual sector, including limited diversification.

Third-party links are being provided for informational purposes only. SPC and S&M are not affiliated with and do not endorse, authorize, sponsor, verify or monitor any of the listed websites or their respective sponsors, and they are not responsible or liable for the content of any website, or the collection or use of information regarding any website's users and/or members. Links are believed to be accurate at time of dissemination, but we make no guarantee, expressed or implied, to the accuracy of the links subsequently.

This may constitute a commercial email message under the CAN-SPAM Act of 2003. If you do not wish to receive marketing or advertising related email messages from us, please click the “unsubscribe” link within this email message. You will continue to receive emails from us related to servicing your account(s).

Sources:

https://www.barrons.com/articles/stock-market-dow-nasdaq-s-p-500-5e86cfe6?refsec=the-trader&mod=topics_the-trader

https://www.barrons.com/articles/treasury-bonds-haven-safety-banks-aee2abd4?mod=Searchresults

https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value_month=202303

https://www.investopedia.com/ask/answers/why-interest-rates-have-inverse-relationship-bond-prices/

https://www.aaii.com/sentimentsurvey

https://www.investopedia.com/terms/c/contrarian.asp

https://en.wikipedia.org/wiki/It%27s_a_Wonderful_Life

http://www.script-o-rama.com/movie_scripts/i/its-a-wonderful-life-script.html

https://edie.fdic.gov/fdic_info.html#05

https://www.history.com/this-day-in-history/first-masters-golf-tournament

https://www.federalreserve.gov/monetarypolicy/bank-term-funding-program.htm

https://www.carsonwealth.com/insights/market-commentary/market-commentary-the-latest-on-the-banking-crisis/?utm_source=sfmc&utm_medium=email&utm_campaign=weekly-market-commentary&j=2134050&sfmc_sub=110820205&l=380_HTML&u=29759016&mid=100016897&jb=2003

https://www.barrons.com/articles/federal-reserve-bank-bailout-program-8f6284f1

https://www.bloomberg.com/news/articles/2023-03-12/us-moves-to-help-depositors-offer-bank-backstop-in-wake-of-svb

https://www.goodreads.com/author/quotes/755.Benjamin_Graham

Would you like these weekly financial recaps personally delivered to your email inbox? Sign up here: