Stay up-to-date.

Would you like these weekly financial recaps personally delivered to your email inbox? Sign up here:

Human-Centric Wealth Management™

Early last week, Federal Reserve Chair Jerome Powell told Congress the Fed remains committed to bringing inflation down to 2 percent. If economic data continues to come in hot, he said, then it’s likely the Fed will raise rates higher than expected and keep them higher for longer than expected.

Economist Lawrence Summers estimates there is 50 percent chance that the Federal funds rate will be 6 percent or higher before the Fed will reach its inflation target, reported Chris Anstey of Bloomberg. Currently, the effective Fed funds rate is 4.57 percent.

A similar statement made by another Fed official the previous week caused United States Treasury yields to rise in anticipation of rate increases and had little effect on the stock market. After Powell’s comments last week, the stock market headed lower.

As investors considered the Fed’s higher-for-longer stance, news broke that a publicly traded bank had been put into receivership by the FDIC. The bank was not huge, but it was a major lender for technology start-ups. Here’s what happened:

Technology companies began to withdraw money from their accounts at the bank to fund operations. This was necessary because rapidly rising rates have made borrowing more expensive and venture capital is more difficult to attract. In turn, the bank liquidated some of its Treasury portfolio at a loss to cover the withdrawals. When the sale and loss was announced, there was a run on the bank as some large venture capitalists and start-up technology firms withdrew their money, reported Low De Wei and Priscila Azevedo Rocha of Bloomberg.

The bank’s closure had a ripple effect, and the value of many bank stocks fell sharply in the United States and overseas. “At first glance, this does not look like a systemic issue. Markets are very sensitive to bad news from the banking sector and worries about it are never good. That being said, one must be very vigilant about any kind of domino effect.” - Bloomberg

As some speculated that events in the banking industry might cause the Fed to slow the pace of rate hikes, Friday’s employment report was released. The number of jobs created again exceeded expectations.

The U.S. labor market continued to surprise with another month of robust job creation in February. But under the surface, the details were a bit more mixed. The good news is that more people joined the workforce, including women and minorities, and wage growth for many workers actually accelerated. On the other hand, job gains were concentrated in just a few industries and the number of hours worked on average declined.

Molly Smith, Bloomberg

Since SVB was closed, Signature Bank was also closed by regulators. Markets are likely to be volatile this week. Major U.S. stock indices finished last week lower. Treasury yields also moved lower, and the yield curve remained inverted.

Founded in 1983, Silicon Valley Bank’s parent company, SVB Financial, announced on Wednesday it had sold $21 billion in assets to raise cash and was taking a $1.8 billion loss while also trying to raise capital. Due to dwindling deposits and losses in its holdings, the bank was forced to sell to shore up its books. As a result, there was a classic run on the bank, as customers demanded their money back. In less than 48 hours, the 16th largest bank in the U.S., with $209 billion in total assets as of the end of 2022, was gone. In fact, it is estimated customers tried to withdraw $42 billion on Thursday alone, about a quarter of the bank’s overall deposits.

As a result of the flood of withdrawals, the bank had a negative cash balance of close to $1 billion and couldn’t cover its payments, so the FDIC took over on Friday morning.

Why did this happen to SVB? The bank was quite unique in that it focused on technology and health care companies, along with venture capital and startups. In fact, it provided almost half of the financing for U.S. venture-backed technology and health care companies. So, whereas traditional banks had various types of customers, SVB’s client base was quite lopsided. This worked great when tech and startups soared from 2015 until 2021, but that all changed in 2022.

The technology sector was hit hard by rising interest rates last year. Instead of depositing money in the bank, tech companies took out more and more to cover their bills. SVB also had enormous unrealized losses in its portfolios of mortgage bonds and Treasury bonds. Combined, it was the perfect cocktail for trouble.

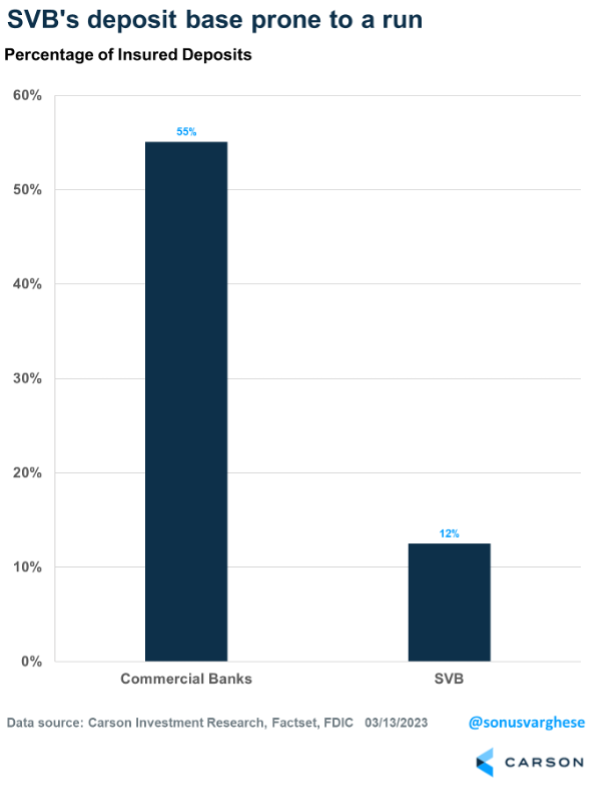

Silicon Valley Bank was unlike nearly any other bank, and its portfolio set it up for distress. Bank accounts are insured up to $250,000, according to the FDIC, but most of the accounts at SVB were well above this important threshold. That meant when trouble came, investors wanted their money back fast. In fact, only 12% of its overall deposits were insured, compared with the average commercial bank’s rate of 55%.

Respected Wells Fargo analyst Mike Mayo said the issue was the diversity of deposits, with most customers being venture-capital firms. Larger banks won’t be as pressured. “To us, the larger the bank, the more diversified the funding,” Mayo explained. “This is part of the test that the largest banks, i.e., the ones that caused the Global Financial Crisis, are today the more resilient portion of both the banking and financial systems.”

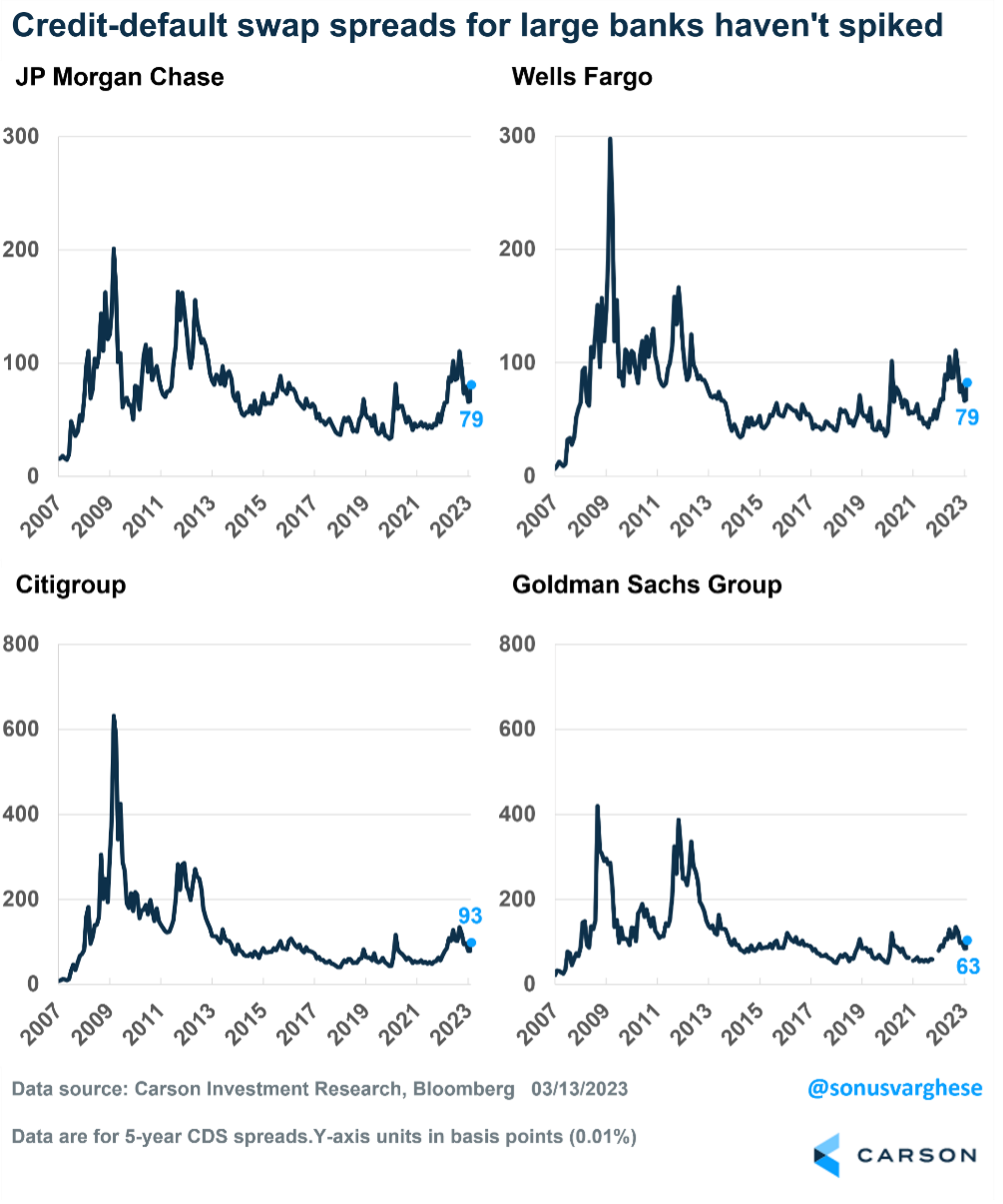

Although bank stocks and the financial industry in general had a historically bad week, it was worthwhile to note that credit markets remained calm. In fact, credit default swaps of large banks didn’t show any signs of stress, suggesting things are contained as of now. Additionally, the U.S. dollar weakened late in the week. Historically, the U.S. dollar finds a bid under times of extreme stress.

We will continue to monitor these events closely. We are hopeful that the fall of SVB is isolated but we are aware of concern being raised about other banks.

The Fed Steps In To Prevent a Broader Crisis

Late Sunday evening, the Federal Reserve, Treasury, and FDIC issued a joint statement that all deposits at SVB will be protected. At the same time, shareholders and some debtholders will not be protected.

The Fed is making available additional funding for banks across the U.S. to make sure they can meet all the needs of their depositors. This is a massive step and will help banks avoid the situation that happened at SVB. It will also bolster confidence in the banking system and prevent contagion.

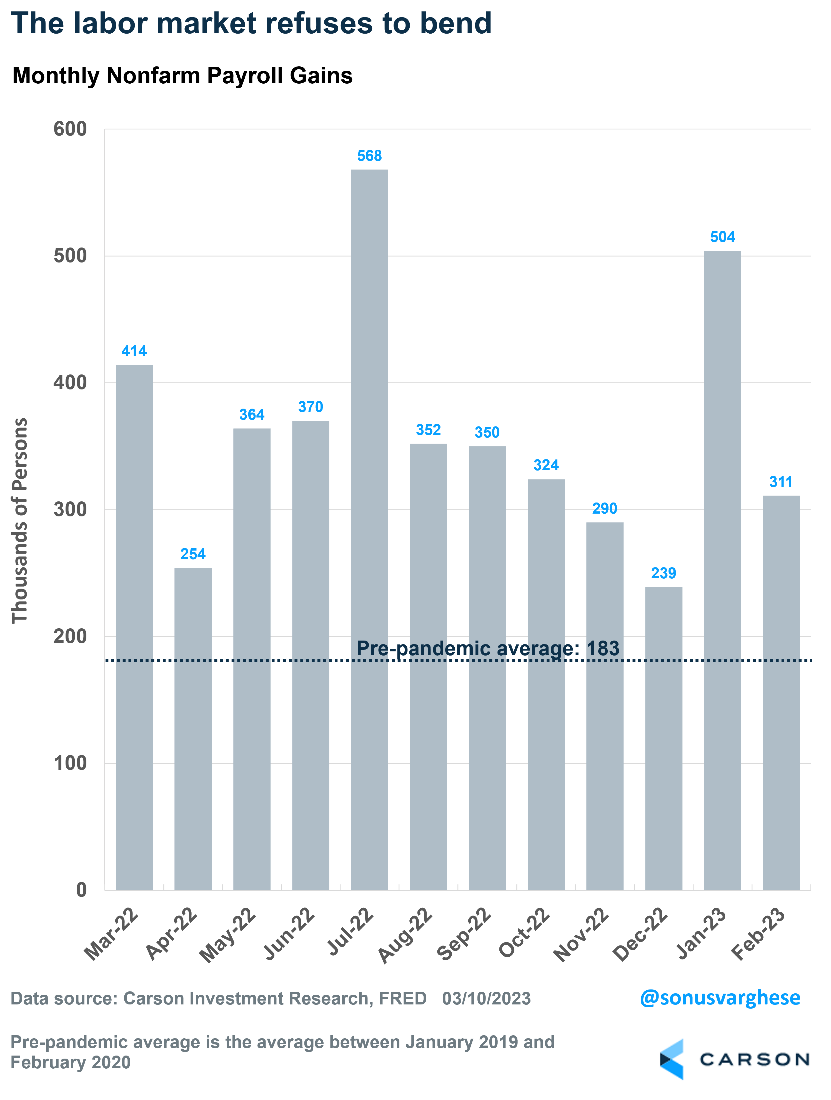

Another month, another solid employment report. Employment rose by 311, 000 in February, on the back of 504,000 in January and 239,000 in December. It’s certainly been a warm winter. This is the labor market that refuses to give in, despite the Fed throwing almost 500 bps (5%-points) of rate hikes at the economy and gearing up for more.

Yes, the unemployment rate rose to 3.6%, up from 3.4% in January. However, that was entirely for positive reasons.

The unemployment rate, as the Bureau of Labor Statistics measures it, is the number of people unemployed who are looking for work divided by the size of the labor force. Last month, the number of unemployed people looking for work rose by about 240,000. However, that’s because 419,000 people “entered” the labor force, i.e., started looking for work. That’s a sign of a healthy labor market. People will start looking for work only if they think they can get a job.

The labor force measure has issues related to how participation is measured. It counts someone as being in the labor force only if someone is looking for work. But a lot of people may not do so for any number of reasons, including not feeling confident in the job market, or non-economic reasons, such as not having access to childcare. The measure also can fall over time because of retiring baby boomers.

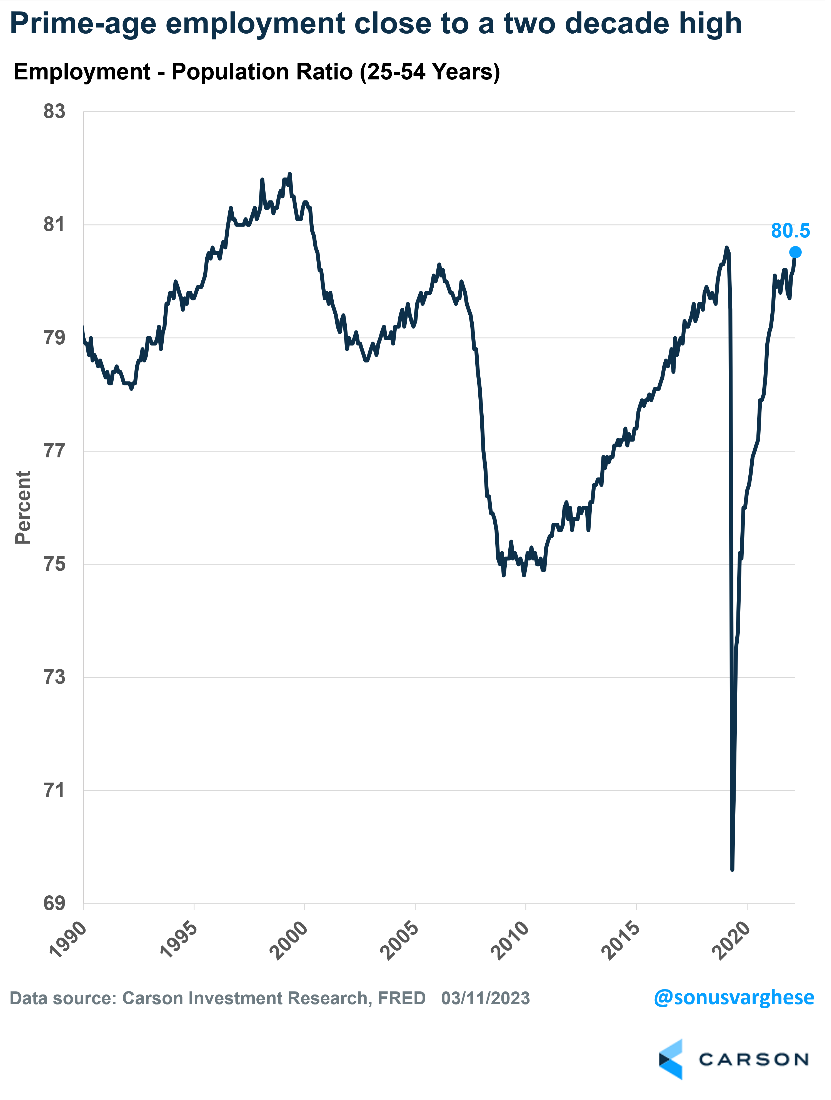

One way to get around these issues is to look at the employment-population ratio for prime-age workers, i.e., workers aged 25-54 years. This measures the number of people working as a percentage of the civilian population. Think of it as the opposite of the unemployment rate, and because we use prime age, we get around the demographic issue as well.

The good news is the prime-age employment-population ratio just hit 80.5%, which is close to the highest level we’ve seen in a couple of decades.

It helps to recall that we just had a multi-generational black swan event in the form of a pandemic. But once everything reopened, the expectation was the economy would bounce back immediately. Several areas did, including GDP, employment, and consumption.

However, a lot of people left the labor force amid the pandemic. Now people are flowing back into the labor force monthly and finding jobs quickly. Just over the past six months, 1.5 million more people have come into the labor force as prospects for finding a job improve.

Strong Labor Market

In its model for the economy, the Fed believes a tight labor market results in stronger wage growth, which drives demand higher and pushes up prices and inflation.

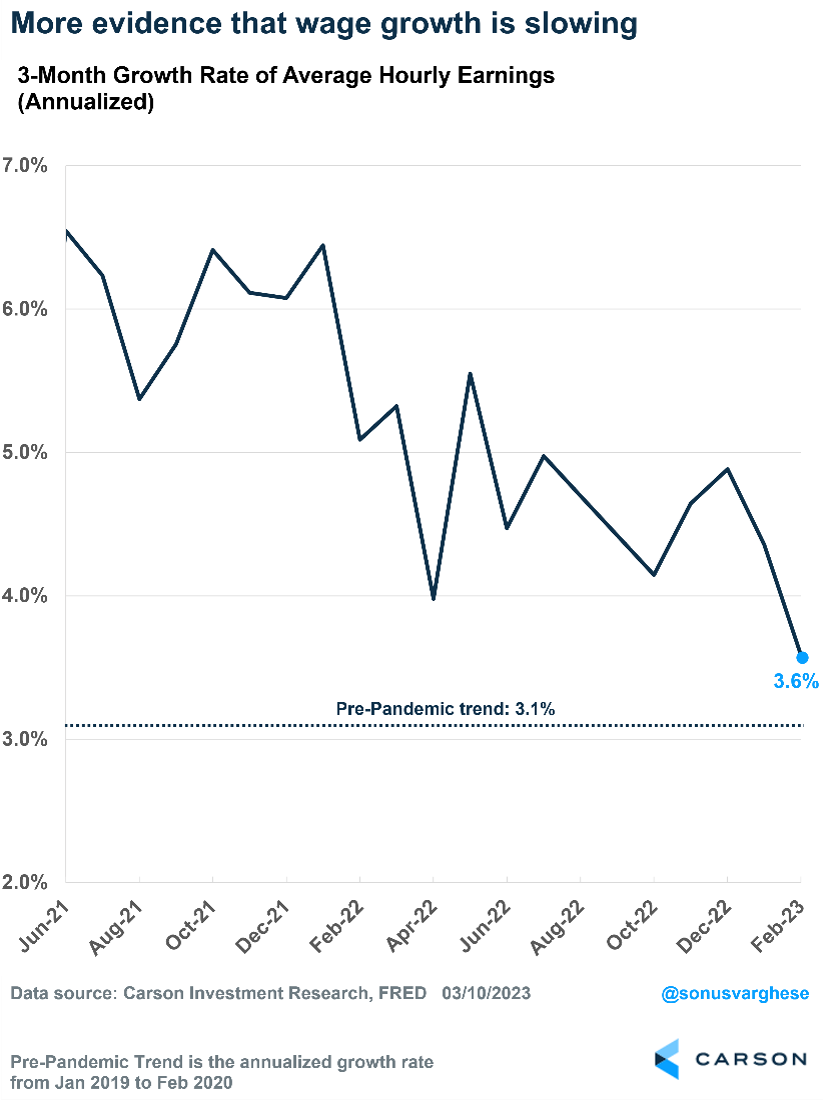

Hopefully the Fed can rest easy on that front. Average hourly earnings rose just 0.2% in February. Over the past three months, wages have grown at an annualized pace of 3.6%, well below the 6%+ pace we saw last year. It’s getting very close to the pre-pandemic pace of 3.1%.

The big question is whether the Fed buys this narrative. Fed Chair Jerome Powell’s comments last week before Congress, for his semi-annual testimony on monetary policy, did not inspire confidence. It looks like a string of hot economic data has left Fed officials questioning their decision to ease the pace of rate increases from 0.5% to 0.25% (as of February) and wondering if they should move that back up to 0.25% at their March meeting. At this point, markets think the outcome is more or less a coin toss, which is not great as Powell simply injected maximum uncertainty into the markets.

Beyond the Fed’s March meeting, the labor market remains strong. This means the economy remains strong, and that’s encouraging for markets. However, it also means the Fed may keep interest rates higher, for longer.

The deadline to make 2022 contributions to your IRA or Roth IRA is April 18, 2023. The total contributions that you can make annually to these accounts cannot be more than the following:

If you have already contributed the maximum amount allowed for 2022, the total contributions that can be made in 2023 are:

If you are unsure of how much you have contributed to your IRA or Roth IRA for the year 2022, or would like assistance in opening one of these accounts, please contact us.

March 17, 1601: First St. Patrick’s Day Parade

Records show that the first St. Patrick’s Day parade was held on March 17, 1601 in a Spanish colony under the direction of the colony's Irish vicar, Ricardo Artur.

Saint Patrick, who was born in the late 4th century, was one of the most successful Christian missionaries in history. Born in Britain to a Christian family of Roman citizenship, he was taken prisoner at the age of 16 by a group of Irish raiders who attacked his family’s estate. They transported him to Ireland, and he spent six years in captivity before escaping back to Britain.

The first recorded St. Patrick’s Day parade in New York City was held in 1762, and with the dramatic increase of Irish immigrants to the United States in the mid-19th century, the March 17th celebration became widespread. Today, across the United States, millions of Americans of Irish ancestry celebrate their cultural identity and history by enjoying St. Patrick’s Day parades and engaging in general revelry.

A luxury, once enjoyed, becomes a necessity.

C. Northcote Parkinson, Historian

The only difference between death and taxes is that death doesn’t get worse every time Congress meets.

Will Rogers, Social Commentator

Investment advisory services offered through SPC Financial® (SPC). *Tax services and analysis are provided by the related firm, Sella & Martinic (S&M), through a separate engagement letter with clients. SPC and S&M do not accept orders and/or instructions regarding your investment account by email, voicemail, fax or any alternative method. Transactional details do not supersede normal trade confirmations or statements.

Email through the Internet is not secure or confidential. SPC and S&M reserve the right to monitor all email. Any information provided in this message has been prepared from sources believed to be reliable, but is not guaranteed by SPC or S&M, their owners or employees, and is not a complete summary or statement of all available data necessary for making a financial decision.

Any information provided is for informational purposes only and does not constitute a recommendation. SPC and S&M, including their owners or employees may own securities mentioned in this email or options, rights, or warrants to purchase or sell these securities.

SPC does not provide tax or legal advice. Before making a legal, investment, or tax decision, contact the appropriate professional. Any tax information or advice contained in this message is confidential and subject to the Accountant/Client Privilege.

This email is intended only for the person or entity to which it is addressed and may contain confidential and/or privileged material. Any review, retransmission, dissemination, or other use of, or taking of any action in reliance upon, this information by persons or entities other than the intended recipient is prohibited. If you received this message in error, please notify the sender and delete the material from your computer immediately. SPC and S&M shall not be liable for the improper or incomplete transmission of the information contained in this communication or for any delay in its receipt or damage to your system.

Portions of this newsletter were prepared by Carson Group Coaching. Carson Group Coaching is not affiliated with SPC or S&M. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. This information is not intended as a solicitation of an offer to buy, hold, or sell any security referred to herein. There is no assurance any of the trends mentioned will continue in the future.

Any expression of opinion is as of this date and is subject to change without notice. Opinions expressed are not intended as investment advice or to predict future performance. Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful. Past performance does not guarantee future results. Investing involves risk, including loss of principal. Consult your financial professional before making any investment decision. Stock investing involves risk including loss of principal. Diversification and asset allocation do not ensure a profit or guarantee against loss. There is no assurance that any investment strategy will be successful.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. The Dow Jones Industrial Average (DJIA), commonly known as "The Dow" is an index used to measure the daily stock price movements of 30 large, publicly owned U.S. companies. The NASDAQ composite is an unmanaged index of securities traded on the NASDAQ system.

The MSCI ACWI (All Country World Index) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. As of June 2007, the MSCI ACWI consisted of 48 country indices comprising 23 developed and 25 emerging market country indices. Bond prices and yields are subject to change based upon market conditions and availability. If bonds are sold prior to maturity, you may receive more or less than your initial investment. There is an inverse relationship between interest rate movements and fixed income prices. Generally, when interest rates rise, fixed income prices fall and when interest rates fall, fixed income prices rise.

The Bloomberg Barclays US Aggregate Bond Index is a market capitalization-weighted index, meaning the securities in the index are weighted according to the market size of each bond type. Most U.S. traded investment grade bonds are represented.

Please note, direct investment in any index is not possible. Sector investments are companies engaged in business related to a specific sector. They are subject to fierce competition and their products and services may be subject to rapid obsolescence. There are additional risks associated with investing in an individual sector, including limited diversification.

Third-party links are being provided for informational purposes only. SPC and S&M are not affiliated with and do not endorse, authorize, sponsor, verify or monitor any of the listed websites or their respective sponsors, and they are not responsible or liable for the content of any website, or the collection or use of information regarding any website's users and/or members. Links are believed to be accurate at time of dissemination, but we make no guarantee, expressed or implied, to the accuracy of the links subsequently.

This may constitute a commercial email message under the CAN-SPAM Act of 2003. If you do not wish to receive marketing or advertising related email messages from us, please click the “unsubscribe” link within this email message. You will continue to receive emails from us related to servicing your account(s).

Sources:

https://www.federalreserve.gov/newsevents/testimony/powell20230307a.htm

https://www.bloomberg.com/news/articles/2023-03-10/summers-sees-nearly-50-50-odds-fed-must-hike-to-6-or-higher

https://www.newyorkfed.org/markets/reference-rates/effr

https://www.reuters.com/markets/us/feds-waller-if-data-stays-hot-policy-rate-should-go-above-51-54-2023-03-02/

https://www.barrons.com/market-data?mod=BOL_TOPNAV

https://www.history.com/this-day-in-history/first-st-patricks-day-parade

https://www.bloomberg.com/news/articles/2023-03-10/why-svb-was-hit-by-a-bank-run-and-where-it-could-lead-quicktake

https://www.bloomberg.com/news/articles/2023-03-10/svb-crisis-reactions-market-strategists-put-interest-rates-in-spotlight

https://www.reuters.com/markets/global-markets-wrapup-1-2023-03-10/

https://www.bloomberg.com/news/articles/2023-03-10/the-good-and-the-bad-what-us-jobs-data-show-about-labor-market

https://www.reuters.com/markets/global-markets-wrapup-1-2023-03-10/

https://www.carsonwealth.com/insights/market-commentary/market-commentary-silicon-valley-bank-isnt-the-first-domino/

https://www.sciencedirect.com/science/article/pii/S2772566921000033

https://www.reuters.com/world/europe/war-worms-polish-politicians-give-each-other-mouthful-over-edible-insects-2023-03-03/

https://www.goodreads.com/quotes/tag/open-mindedness

Would you like these weekly financial recaps personally delivered to your email inbox? Sign up here: