Stay up-to-date.

Would you like these weekly financial recaps personally delivered to your email inbox? Sign up here:

Human-Centric Wealth Management™

Is it good news or bad news?

The answer depends on your perspective. Last week, we learned that:

Consumer sentiment is at its highest level in more than a year. Consumers are feeling better about current economic conditions and the future. That said, the University of Michigan Index of Consumer Sentiment remains 20 points below its long-term average. Consumer expectations for inflation over the next year increased from 3.9 percent to 4.1 percent and, over the longer term, consumers anticipate inflation will average about 2.9 percent.

Americans spent more money in January. Consumer spending is the primary driver of economic growth in the United States, which rose in January.

Consumers’ spending increased and after-tax incomes rose...Taken together, these indicators are the latest evidence that the U.S. economy started the year on a strong note — bucking signs of a slowdown at the end of last year.

Courtenay Brown, Axios

Business conditions improved in the U.S., overall. In the United States, business conditions improved as demand for services increased, reported Lucia Mutikani of Reuters. In February, the S&P Global Flash U.S. Composite PMI Output Index came in at 50.2. Readings above 50 indicate the economy is expanding. For the last seven months, the reading has been below 50.

The long tails of fiscal stimulus, for example, have propped up the economy for far longer than anyone expected. Excess consumer savings and an ebullient labor market fueled demand for travel, restaurant dining, and other services, where spending still has room to grow. And years of low interest rates have transformed the debt dynamics for the overwhelming majority of U.S. households, leaving them largely shielded, through fixed-rate mortgages, from the impacts of the Federal Reserve’s primary tightening tool.

Megan Cassella, Barron’s

Business conditions improved in many parts of the world. February’s Flash PMI readings were above 50 for many regions, including the Eurozone (52.3), the United Kingdom (53.0), Japan (50.7), and China (50.1).

Greater optimism, improving business conditions, higher incomes, and more are positive developments. The negative is that they helped push inflation in the wrong direction. One of the Federal Reserve’s favored inflation indices showed inflation moving higher from December to January. That’s not what the Fed wanted to see. It has been working aggressively to tame inflation and recent economic data suggests it has more to work to do.

Major U.S. stock indices finished the week lower, according to Nicholas Jasinski of Barron’s. Treasury yields rose across many maturities.

The past few weeks we have been on the lookout for seasonal late February/early March weakness. After the 11th best start to a year ever as of Valentine’s Day, some sluggishness was expected. Well, stocks had their worst week of the year last week and are now down three weeks in a row for the first time since December.

The S&P 500 is still 11% above the October lows and we do not anticipate new lows. After nearly a 17% rally, this weakness is perfectly normal.

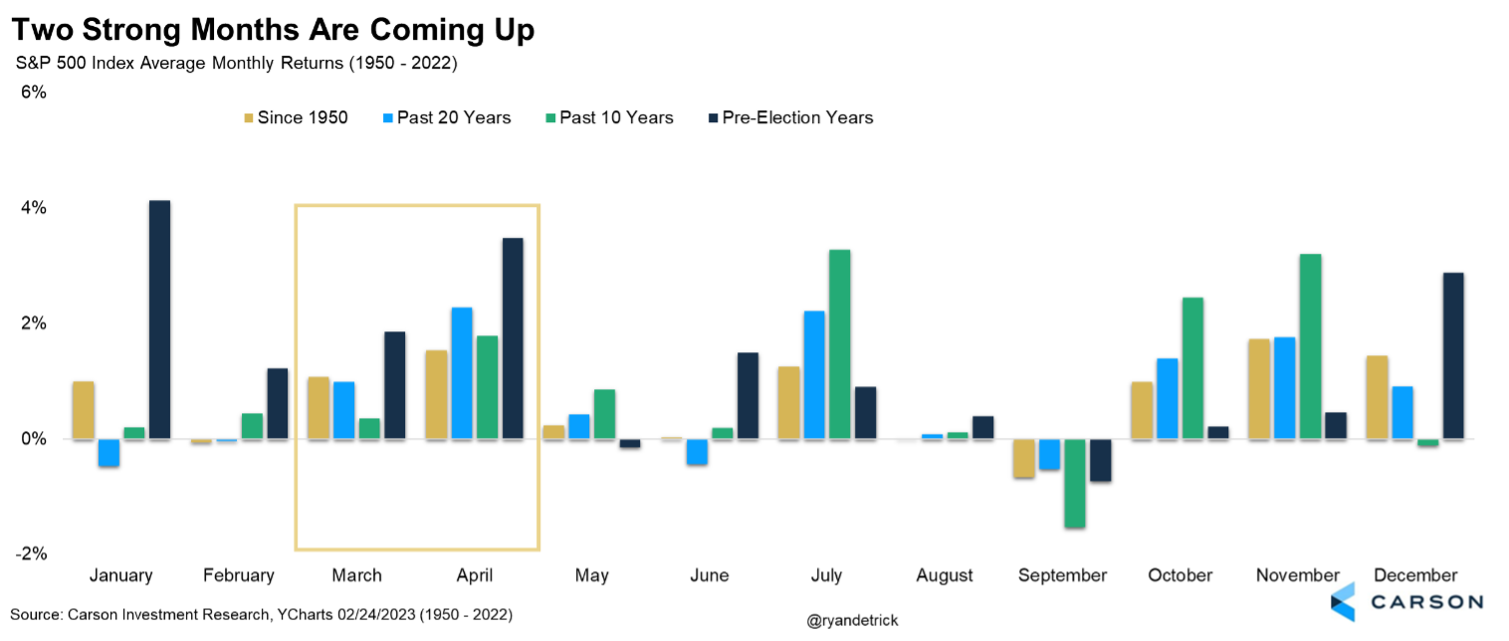

Here’s the good news: The next two months are typically some of the best months of the year and are even better in a pre-election year. We’ve seen signs of consistently bearish sentiment and worry, which is exactly what we want to see for a tradeable bottom to form.

Volatility has returned to the equity markets. Ironically, this has come amid a slew of stronger than expected economic data, including payrolls and consumption. Consumer confidence is also rising.

The problem is inflation numbers have stopped decelerating as fast as they were a few months ago. Inflation is much lower than it was last year, but it is still elevated. Part of the reason is a strong economy is putting upward pressure on prices, including discretionary spending, such as eating out, going to movies/concerts, recreational activities, and buying clothes and household goods.

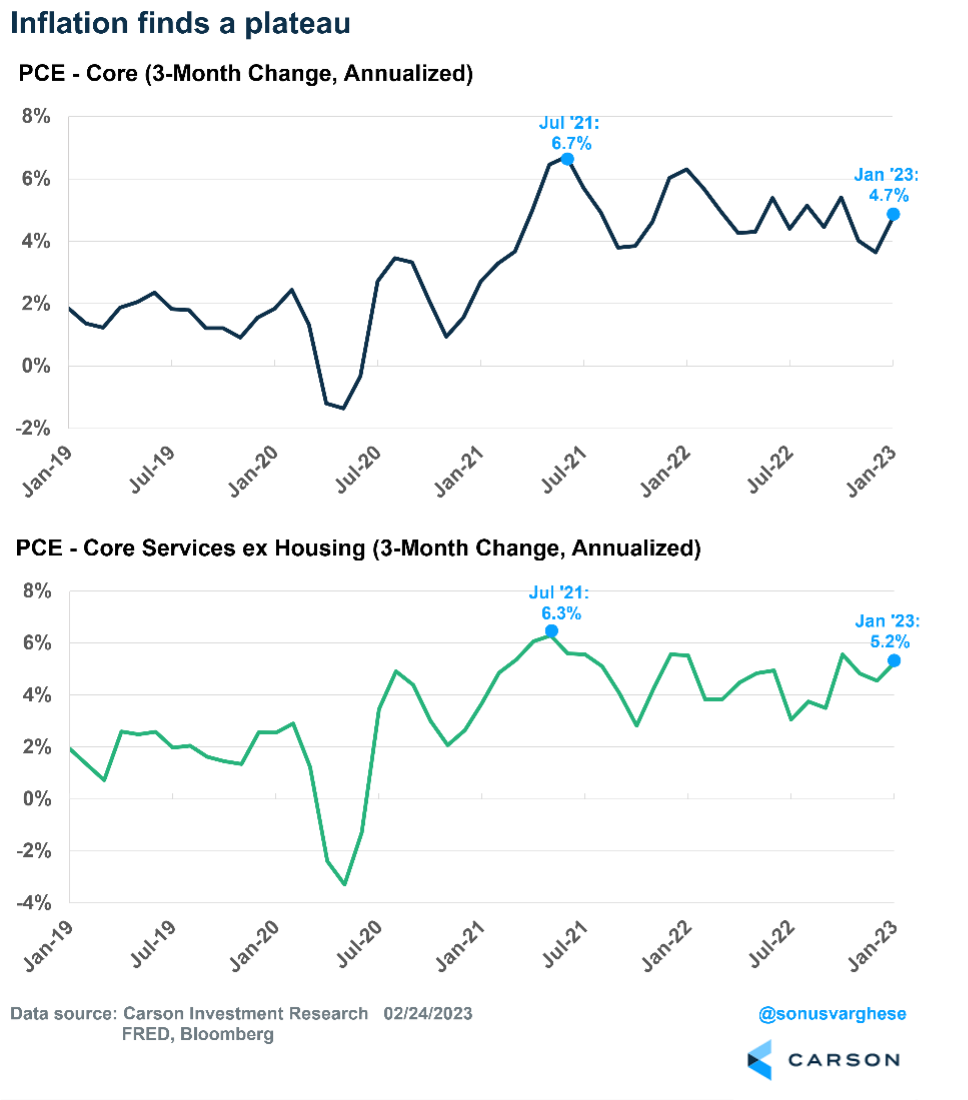

The latest PCE (personal consumption expenditures) inflation data, the Fed’s preferred inflation index, confirms that narrative. Core inflation, which excludes food and energy, has been running at a 4.7% annualized pace over the past three months. That’s down from the peak of 6.7% we saw 18 months ago, but it’s still high. Recently, Federal Reserve Chair Jerome Powell has talked about keeping an eye on core services ex housing inflation as well. That has been running at an annualized pace of 5.2% over the past three months and has more or less plateaued.

Core services, ex housing, tend to be correlated to wage growth, and there is fairly strong evidence that wage growth is decelerating, which should ultimately push core inflation lower.

However, until that actually shows up in the official data, the Fed may continue pushing interest rates higher and keeping them there.

More Uncertainty Around the Fed

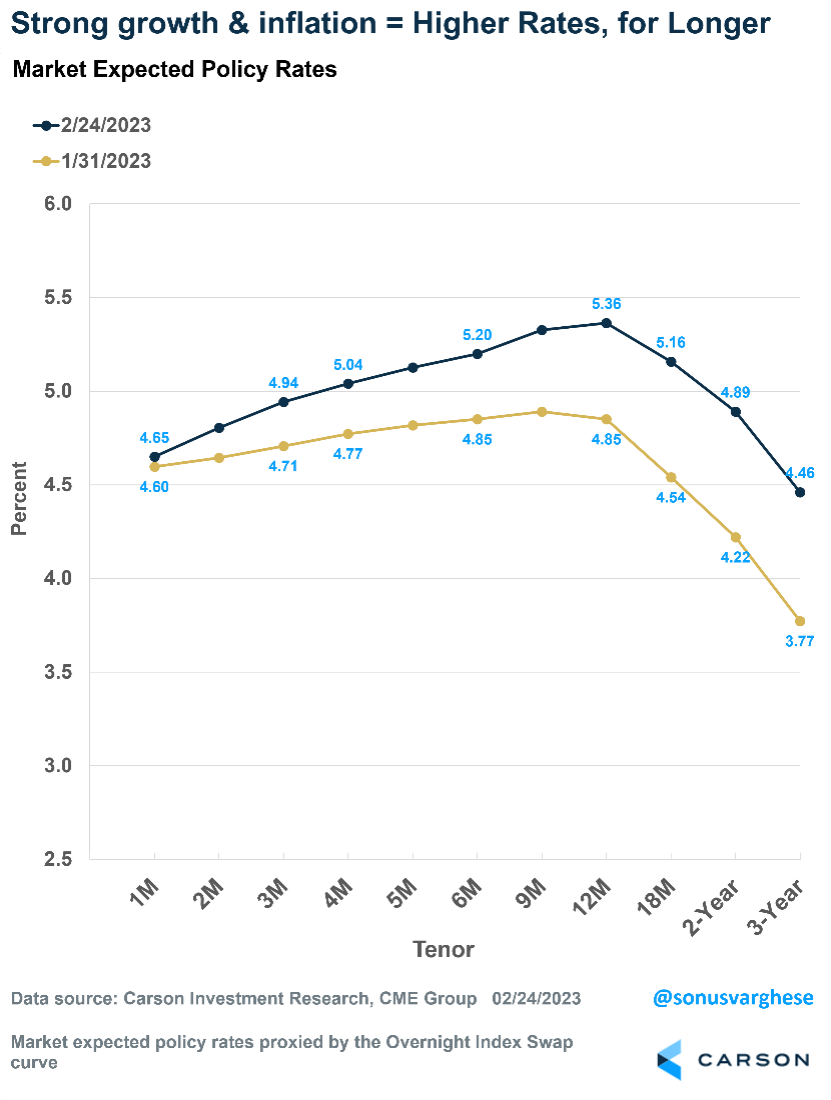

Three weeks is not a very long time, but that’s all it took for investors to move up their interest rate expectations. At the end of January, the expectation was for the Fed to reach a peak rate (for the federal funds rate) of about 4.9% by the end of the year, followed by a series of cuts over the following year.

That’s shifted quite significantly, with markets expecting the “terminal rate” to move as high as 5.36% by the end of this year. That translates to an additional 0.50% of rate hikes this year. The expectation is that the Fed will raise rates by 0.25% over the next three meetings, i.e., March, May, and June. Previously, the expectation was for rate hikes to be done in March.

In fact, there’s even a 27% probability that the Fed raises rates by 0.50% at its March meeting. Higher market odds reflect uncertainty about what the Fed is going to do, which has added to market volatility.

Also, as the chart above shows, higher rates are expected for longer. Investors now expect the federal funds rate to be above 5% even in June 2024. Three weeks ago, they expected rates to fall to around 4.5% by then.

All in all, we’ve gone from a period of apparent consensus on what the terminal rate would be to renewed uncertainty. And that’s happened on the back of firmer core inflation readings and stronger than expected economic data.

We think strong economic data is good news, which will ultimately be reflected in stocks. Wage growth data also indicates inflation will continue decelerating. It just may not happen as quickly as anyone would like, for several reasons, including how official data is measured.

The deadline to make 2022 contributions to your IRA or Roth IRA is April 18, 2023. The total contributions that you can make annually to these accounts cannot be more than the following:

If you have already contributed the maximum amount allowed for 2022, the total contributions that can be made in 2023 are:

If you are unsure of how much you have contributed to your IRA or Roth IRA for the year 2022, or would like assistance in opening one of these accounts, please contact us.

March 3, 1875: First Indoor Game of Ice Hockey

On March 3, 1875, indoor ice hockey made its public debut in Montreal, Quebec. After weeks of training at the Victoria Skating Rink with his friends, Montreal resident James Creighton advertised in the March 3 edition of the Montreal Gazette that “A game of hockey will be played in the Victoria Skating Rink this evening between two nines chosen from among the members.” Prior to the move indoors, ice hockey was a casual outdoor game, with no set dimensions for the ice and no rules regarding the number of players per side. The Victoria Skating Rink was snug, so Creighton limited the teams to nine players each.

Hockey, traditionally played on grass with a stick and a ball, has its roots in ancient Greece, Egypt and Persia. In this form, the game spread north to Europe and then west to the Americas, and is still popular in the Southern Hemisphere as well as in North America, where it is called field hockey.

Ice hockey was initially thought too dangerous a game to play, as the ball was difficult to control on the ice. For the 1875 Montreal game, the ball was replaced with a wooden disc, now known as a puck. The disc was less likely to fly off the ice, and was less dangerous to both players and spectators. Creighton also instituted an early off-sides rule, mandating that there be no forward passing ahead of the player with the puck. The Montreal Gazette reported the next day that the first ice hockey game at Victoria Skating Rink attracted 40 spectators. Ice hockey then caught fire in Montreal, and in 1877 Creighton published rules to the game, known as Montreal Rules. Canada’s now legendary national passion for ice hockey was ignited, and the new sport began to spread across the country.

It’s not what you don’t know that kills you, it’s what you know for sure that ain’t true.

Mark Twain, Writer

If you are not consciously building your habits, they are unconsciously building you.

Anika J. Green, Author

Investment advisory services offered through SPC Financial® (SPC). *Tax services and analysis are provided by the related firm, Sella & Martinic (S&M), through a separate engagement letter with clients. SPC and S&M do not accept orders and/or instructions regarding your investment account by email, voicemail, fax or any alternative method. Transactional details do not supersede normal trade confirmations or statements.

Email through the Internet is not secure or confidential. SPC and S&M reserve the right to monitor all email. Any information provided in this message has been prepared from sources believed to be reliable, but is not guaranteed by SPC or S&M, their owners or employees, and is not a complete summary or statement of all available data necessary for making a financial decision.

Any information provided is for informational purposes only and does not constitute a recommendation. SPC and S&M, including their owners or employees may own securities mentioned in this email or options, rights, or warrants to purchase or sell these securities.

SPC does not provide tax or legal advice. Before making a legal, investment, or tax decision, contact the appropriate professional. Any tax information or advice contained in this message is confidential and subject to the Accountant/Client Privilege.

This email is intended only for the person or entity to which it is addressed and may contain confidential and/or privileged material. Any review, retransmission, dissemination, or other use of, or taking of any action in reliance upon, this information by persons or entities other than the intended recipient is prohibited. If you received this message in error, please notify the sender and delete the material from your computer immediately. SPC and S&M shall not be liable for the improper or incomplete transmission of the information contained in this communication or for any delay in its receipt or damage to your system.

Portions of this newsletter were prepared by Carson Group Coaching. Carson Group Coaching is not affiliated with SPC or S&M. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. This information is not intended as a solicitation of an offer to buy, hold, or sell any security referred to herein. There is no assurance any of the trends mentioned will continue in the future.

Any expression of opinion is as of this date and is subject to change without notice. Opinions expressed are not intended as investment advice or to predict future performance. Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful. Past performance does not guarantee future results. Investing involves risk, including loss of principal. Consult your financial professional before making any investment decision. Stock investing involves risk including loss of principal. Diversification and asset allocation do not ensure a profit or guarantee against loss. There is no assurance that any investment strategy will be successful.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. The Dow Jones Industrial Average (DJIA), commonly known as "The Dow" is an index used to measure the daily stock price movements of 30 large, publicly owned U.S. companies. The NASDAQ composite is an unmanaged index of securities traded on the NASDAQ system.

The MSCI ACWI (All Country World Index) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. As of June 2007, the MSCI ACWI consisted of 48 country indices comprising 23 developed and 25 emerging market country indices. Bond prices and yields are subject to change based upon market conditions and availability. If bonds are sold prior to maturity, you may receive more or less than your initial investment. There is an inverse relationship between interest rate movements and fixed income prices. Generally, when interest rates rise, fixed income prices fall and when interest rates fall, fixed income prices rise.

The Bloomberg Barclays US Aggregate Bond Index is a market capitalization-weighted index, meaning the securities in the index are weighted according to the market size of each bond type. Most U.S. traded investment grade bonds are represented.

Please note, direct investment in any index is not possible. Sector investments are companies engaged in business related to a specific sector. They are subject to fierce competition and their products and services may be subject to rapid obsolescence. There are additional risks associated with investing in an individual sector, including limited diversification.

Third-party links are being provided for informational purposes only. SPC and S&M are not affiliated with and do not endorse, authorize, sponsor, verify or monitor any of the listed websites or their respective sponsors, and they are not responsible or liable for the content of any website, or the collection or use of information regarding any website's users and/or members. Links are believed to be accurate at time of dissemination, but we make no guarantee, expressed or implied, to the accuracy of the links subsequently.

This may constitute a commercial email message under the CAN-SPAM Act of 2003. If you do not wish to receive marketing or advertising related email messages from us, please click the “unsubscribe” link within this email message. You will continue to receive emails from us related to servicing your account(s).

Sources:

http://www.sca.isr.umich.edu

https://www.axios.com/2023/02/24/inflation-spending-federal-reserve-january-2023

https://www.reuters.com/markets/us/us-business-activity-rebounds-eight-month-high-february-sp-global-survey-2023-02-21/

https://www.pmi.spglobal.com/Public/Home/PressRelease/1a48b2fdf6114741aade2fd71f25f4a6

https://www.barrons.com/articles/economy-recession-interest-rates-inflation-22dd9566?mod=hp_HERO

https://www.pmi.spglobal.com/Public/Home/PressRelease/7fdf85da48494da6bb804fe00a196b7d

https://www.pmi.spglobal.com/Public/Home/PressRelease/1f90583c5e16471fa3c882f3ca302c9d

https://www.history.com/this-day-in-history/first-indoor-game-of-ice-hockey

https://www.pmi.spglobal.com/Public/Home/PressRelease/b45817f8d0e144dab10a0ecce8ee1a68

https://www.reuters.com/world/china/china-economic-activity-swings-back-growth-january-official-pmi-2023-01-31/

https://www.bea.gov/data/personal-consumption-expenditures-price-index

https://www.carsonwealth.com/insights/market-commentary/market-commentary-the-february-hangover-is-nearly-over/

https://www.barrons.com/articles/stock-market-dow-nasdaq-s-p-500-8f364ee2?refsec=the-trader&mod=topics_the-trader

https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value_month=202302

https://www.brainyquote.com/topics/humor-quotes

https://blog.currencyfair.com/money-idioms-from-around-the-world

https://au.finance.yahoo.com/news/12-quirky-sayings-people-around-200012353.html

Would you like these weekly financial recaps personally delivered to your email inbox? Sign up here: