Stay up-to-date.

Would you like these weekly financial recaps personally delivered to your email inbox? Sign up here:

Human-Centric Wealth Management™

There were some unexpected surprises in last week’s economic data that caused markets to reassess expectations for 2023. For example:

Inflation didn’t fall as fast as expected. Last week, the Consumer Price Index showed inflation rose 6.4 percent, year-over-year, in January. That was an improvement over December’s pace and the seventh consecutive month of falling prices, but economists expected price increases to slow more quickly, reported Megan Cassella of Barron’s.

Look into the details, and it is easy to see that the inflation problem is not fixed. America’s ‘core’ prices, which exclude volatile food and energy, grew at an annualized pace of 4.6% over the past three months, and have started gently accelerating. The main source of inflation is now the services sector, which is more exposed to labor costs…It is hard to see how underlying inflation can dissipate while labor markets stay so tight.

The Economist

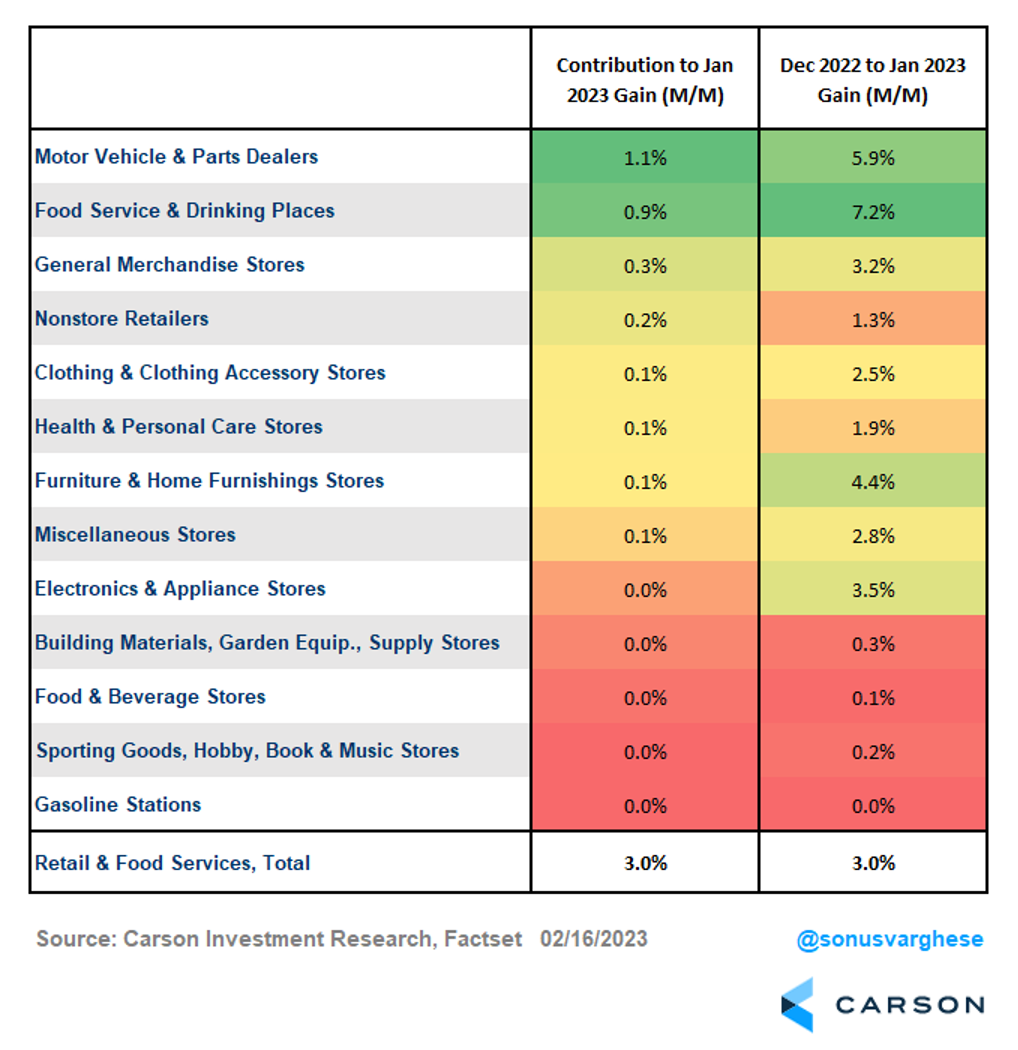

Consumer spending accelerated. Americans were in a buying mood. Retail sales, which is a proxy for consumer spending, rose 3.0 percent in January after declining in November and December of last year, reported the U.S. Census Bureau.

Another day, another item of evidence that the U.S. economy isn’t slowing down anything like as much as many had thought. U.S. retail sales in January rose the most in almost two years, reinforcing the narrative that consumer demand remains strong.

John Authers, Bloomberg

Bullish sentiment in stock markets has been supported by the idea that inflation will continue to slow, and the Fed will be able to ease up on interest rates, reported Al Root of Barron’s. Last week, The Economist suggested stock markets may be overly optimistic. “Investors are pricing stocks for a Goldilocks economy in which companies’ profits grow healthily while the cost of capital falls…This is a rosy picture. Unfortunately, as we explain this week, it is probably misguided. The world’s battle with inflation is far from over.”

Bond markets were less sanguine. After a chorus of Fed officials took the stage to let everyone listening know the federal funds rate would likely need to move higher – and stay higher – for longer, the bond market capitulated, reported William Watts of MarketWatch. As expectations shifted, the yield on a six-month Treasury moved above 5 percent for the first time since 2007 and the yield on a 10-year Treasury hit a new high for the year.

Major U.S. stock indices finished the week mixed. The S&P 500 Index and Dow Jones Industrial Average moved lower, while the Nasdaq Composite Index finished slightly higher. Treasury yields rose across most maturities.

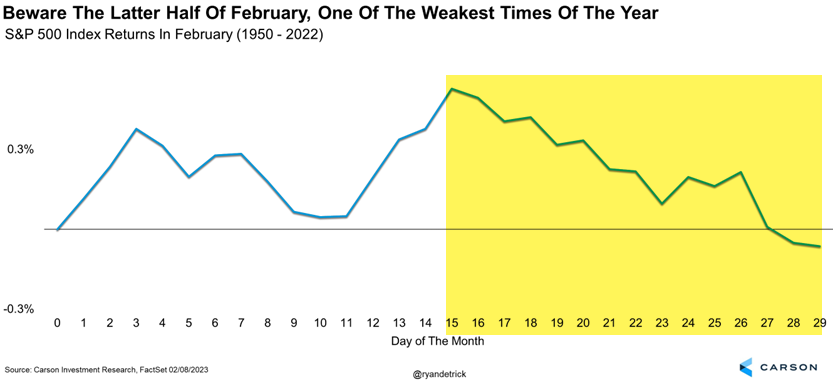

Last week, we noted the potential was high for a well-deserved break for stocks after a red-hot start to the year. That seasonal weakness may have begun. The S&P 500 is typically down in February, which joins September as the only other month to have a negative average monthly return. But as we shared last week (and will share again as we think it is important), trouble usually brews in the later part of the month.

Retail sales and food services surged 3% in January, exceeding expectations for a 1.7% gain. That was the largest monthly increase since March 2021, which came on the back of stimulus checks. So, excluding the 2020-2021 recovery period, which saw large drops and gains, October 2001 was the last month to post larger gains. And even that was a rebound after a depressed September.

Breaking down the report, vehicle sales were the big driver, accounting for more than one-third of the overall gain. But there was broad strength everywhere, including in general merchandise stores, e-commerce, clothing stores, and even furnishings, despite the slowdown in housing activity. Lastly, spending at restaurants and bars rose by a whopping 7.2%, and it wasn’t because of prices, which were up 0.6% last month.

It is very difficult to have a recession when consumers are spending like this, as the consumer makes up close to 70% of the economy. Yes, housing is in a recession and manufacturing likely is as well, so by no means are conditions perfect. Some analysts call this a rolling recession, with parts of the economy in a recession and others not, but those who work in other industries, such as restaurants, had an excellent year. However, restaurants had horrible years in 2020 and 2021 while other sectors of the economy did very well.

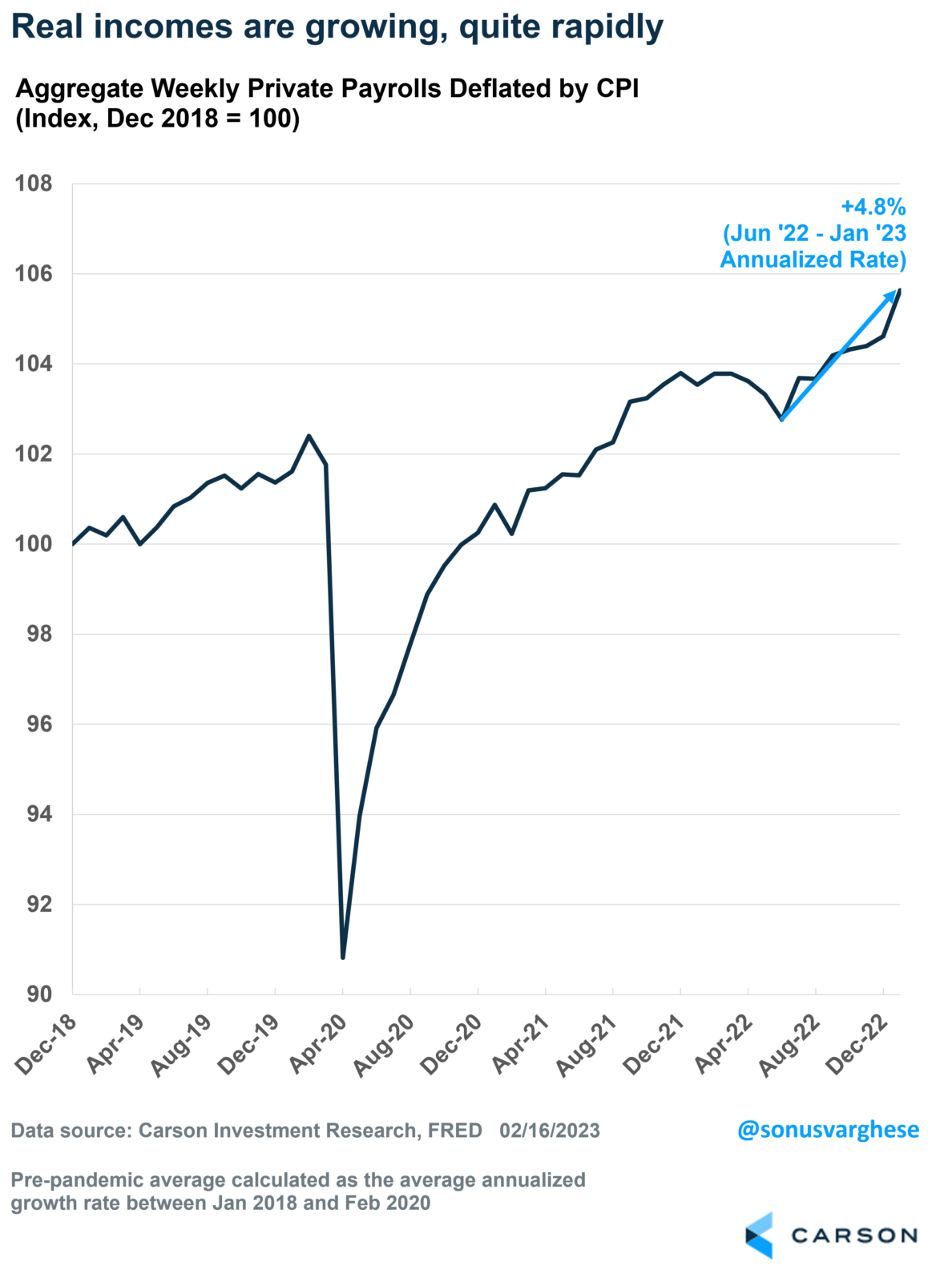

Better Inflation Helps the Consumer

Real retail sales and food services, adjusted for inflation, rose 2.4% in January. That is 9% above the pre-pandemic trend. No matter what seasonality-related adjustments we make, there’s no denying that consumption is strong. The only surprise is how strong goods consumption is running, even as we get further away from the pandemic. The expectation was consumption patterns would normalize by now and goods spending would head back toward trend.

The Big Picture

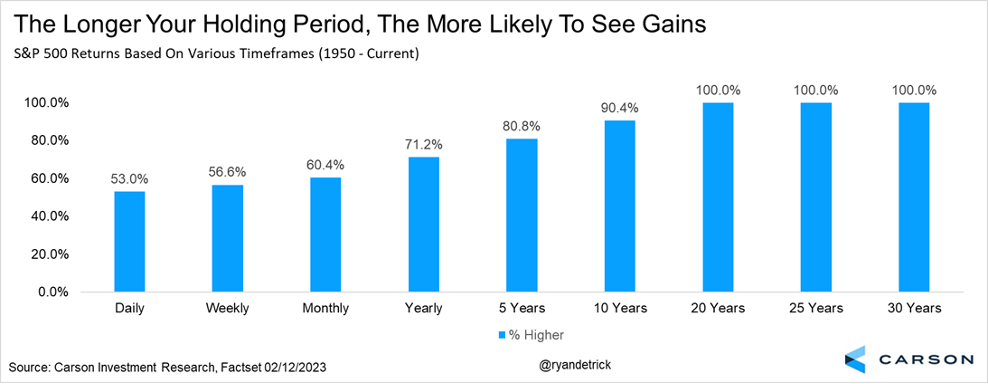

Stocks are one of the best ways to create wealth and beat inflation over the long term, meaning multiple decades.

In fact, the S&P 500 has never been lower, over a 20-year period. Yes, we’ve seen decades when stocks did poorly, such as the 1930 and 2000s. But if investors have a long enough time horizon, the odds of gains are high.

Jack Bogle, founder of Vanguard, once said, “The stock market is a giant distraction to the business of investing.” The daily news and worries are real and likely will impact how investors view their investments, but taking a long-term view is extremely important. Sometimes we are our own worst enemies when it comes to investment decisions. The desire to sell at the worst possible time has influenced investors throughout history. Please contact us if you would like to review your long-term goals.

The 2022 Modern Wealth Survey, which is conducted for Charles Schwab by Logica Research, asked Americans whether personal values are more important to life decisions than they once were. The majority said yes.

“Almost three-quarters of Americans (73%) say their personal values guide how they make life decisions more today than they did two years ago, and nearly an equal number (69%) say that supporting causes they care most about are a top consideration when it comes to their financial decisions…When asked which personal values are their biggest motivators, Americans prioritize doing what’s best for others, including the environment and the greater good as well as their family and friends, followed by saving more and reducing unnecessary spending.”

Defining and prioritizing values takes time and can be a challenging exercise. The Good Project, a research initiative at the Harvard Graduate School of Education’s Project Zero, offers an online value sorting activity. Visitors review a list of 30 values and choose 10 to begin. The list includes options like:

A majority of each generational group that participated in the Modern Wealth Survey agreed that values affect their investment choices: 68 percent of Baby Boomers, 73 percent of Gen X, 75 percent of Millennials, and 82 percent of Gen Z.

Overall, “When looking at the factors that influence investing decisions, a company’s reputation (91%) and its corporate values (81%) are almost as important as more traditional factors like a company’s performance (96%) and its stock price (93%). As personal beliefs and interests become more important, many investors (84%) are also interested in having a more personalized investment portfolio.”

The deadline to make 2022 contributions to your IRA or Roth IRA is April 18, 2023. The total contributions that you can make annually to these accounts cannot be more than the following:

If you have already contributed the maximum amount allowed for 2022, the total contributions that can be made in 2023 are:

If you are unsure of how much you have contributed to your IRA or Roth IRA for the year 2022, or would like assistance in opening one of these accounts, please contact us.

February 21, 1885: Washington Monument Dedicated

On February 21, 1885, the Washington Monument, built in honor of America’s revolutionary hero and first president, was dedicated in Washington, D.C.

The 555-foot-high marble obelisk was first proposed in 1783, and Pierre L’Enfant left room for it in his designs for the new U.S. capital. After George Washington’s death in 1799, plans for a memorial for the “father of the country” were discussed, but none were adopted until 1832–the centennial of Washington’s birth. Architect Robert Mills’ hollow Egyptian obelisk design was accepted for the monument, and on July 4, 1848, the cornerstone was laid. Work on the project was interrupted by political quarreling in the 1850s, and construction ceased entirely during the American Civil War. Finally, in 1876, Congress, inspired by the American centennial, passed legislation appropriating $200,000 for completion of the monument.

In February 1885, the Washington Monument was formally dedicated, and three years later it was opened to the public, who were permitted to climb to the top of the monument by stairs or elevator. The monument was the tallest structure in the world when completed and remains today, by District of Columbia law, the tallest building in the nation’s capital.

Start where you are. Use what you have. Do what you can.

Arthur Ashe, Tennis Player

Learn from the mistakes of others. You can never live long enough to make them yourself.

Groucho Marx, Comedian

Investment advisory services offered through SPC Financial® (SPC). *Tax services and analysis are provided by the related firm, Sella & Martinic (S&M), through a separate engagement letter with clients. SPC and S&M do not accept orders and/or instructions regarding your investment account by email, voicemail, fax or any alternative method. Transactional details do not supersede normal trade confirmations or statements.

Email through the Internet is not secure or confidential. SPC and S&M reserve the right to monitor all email. Any information provided in this message has been prepared from sources believed to be reliable, but is not guaranteed by SPC or S&M, their owners or employees, and is not a complete summary or statement of all available data necessary for making a financial decision.

Any information provided is for informational purposes only and does not constitute a recommendation. SPC and S&M, including their owners or employees may own securities mentioned in this email or options, rights, or warrants to purchase or sell these securities.

SPC does not provide tax or legal advice. Before making a legal, investment, or tax decision, contact the appropriate professional. Any tax information or advice contained in this message is confidential and subject to the Accountant/Client Privilege.

This email is intended only for the person or entity to which it is addressed and may contain confidential and/or privileged material. Any review, retransmission, dissemination, or other use of, or taking of any action in reliance upon, this information by persons or entities other than the intended recipient is prohibited. If you received this message in error, please notify the sender and delete the material from your computer immediately. SPC and S&M shall not be liable for the improper or incomplete transmission of the information contained in this communication or for any delay in its receipt or damage to your system.

Portions of this newsletter were prepared by Carson Group Coaching. Carson Group Coaching is not affiliated with SPC or S&M. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. This information is not intended as a solicitation of an offer to buy, hold, or sell any security referred to herein. There is no assurance any of the trends mentioned will continue in the future.

Any expression of opinion is as of this date and is subject to change without notice. Opinions expressed are not intended as investment advice or to predict future performance. Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful. Past performance does not guarantee future results. Investing involves risk, including loss of principal. Consult your financial professional before making any investment decision. Stock investing involves risk including loss of principal. Diversification and asset allocation do not ensure a profit or guarantee against loss. There is no assurance that any investment strategy will be successful.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. The Dow Jones Industrial Average (DJIA), commonly known as "The Dow" is an index used to measure the daily stock price movements of 30 large, publicly owned U.S. companies. The NASDAQ composite is an unmanaged index of securities traded on the NASDAQ system.

The MSCI ACWI (All Country World Index) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. As of June 2007, the MSCI ACWI consisted of 48 country indices comprising 23 developed and 25 emerging market country indices. Bond prices and yields are subject to change based upon market conditions and availability. If bonds are sold prior to maturity, you may receive more or less than your initial investment. There is an inverse relationship between interest rate movements and fixed income prices. Generally, when interest rates rise, fixed income prices fall and when interest rates fall, fixed income prices rise.

The Bloomberg Barclays US Aggregate Bond Index is a market capitalization-weighted index, meaning the securities in the index are weighted according to the market size of each bond type. Most U.S. traded investment grade bonds are represented.

Please note, direct investment in any index is not possible. Sector investments are companies engaged in business related to a specific sector. They are subject to fierce competition and their products and services may be subject to rapid obsolescence. There are additional risks associated with investing in an individual sector, including limited diversification.

Third-party links are being provided for informational purposes only. SPC and S&M are not affiliated with and do not endorse, authorize, sponsor, verify or monitor any of the listed websites or their respective sponsors, and they are not responsible or liable for the content of any website, or the collection or use of information regarding any website's users and/or members. Links are believed to be accurate at time of dissemination, but we make no guarantee, expressed or implied, to the accuracy of the links subsequently.

This may constitute a commercial email message under the CAN-SPAM Act of 2003. If you do not wish to receive marketing or advertising related email messages from us, please click the “unsubscribe” link within this email message. You will continue to receive emails from us related to servicing your account(s).

Sources:

https://www.barrons.com/articles/january-cpi-inflation-data-report-today-ed1c7258

https://www.economist.com/leaders/2023/02/16/inflation-will-be-harder-to-bring-down-than-markets-think

https://www.census.gov/retail/marts/www/marts_current.pdf

https://www.bloomberg.com/opinion/articles/2023-02-16/no-landing-us-consumers-haven-t-spent-like-this-since-before-lehman

https://www.barrons.com/articles/stock-market-dow-nasdaq-s-p-500-d27ac97?refsec=the-trader&mod=topics_the-trader

https://www.marketwatch.com/story/stock-market-bulls-defiant-as-bond-market-surrenders-to-fed-heres-what-to-watch-c334727e

https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value_month=202302

https://www.carsonwealth.com/insights/market-commentary/market-commentary-weakness-right-on-cue/

https://content.schwab.com/web/retail/public/about-schwab/schwab_modern_wealth_survey_2022_findings.pdf

https://www.aboutschwab.com/modern-wealth-survey-2022

https://www.history.com/this-day-in-history/washington-monument-dedicated

https://www.thegoodproject.org/value-sort

https://www.goodreads.com/quotes/tag/values

Would you like these weekly financial recaps personally delivered to your email inbox? Sign up here: