Stay up-to-date.

Would you like these weekly financial recaps personally delivered to your email inbox? Sign up here:

Human-Centric Wealth Management™

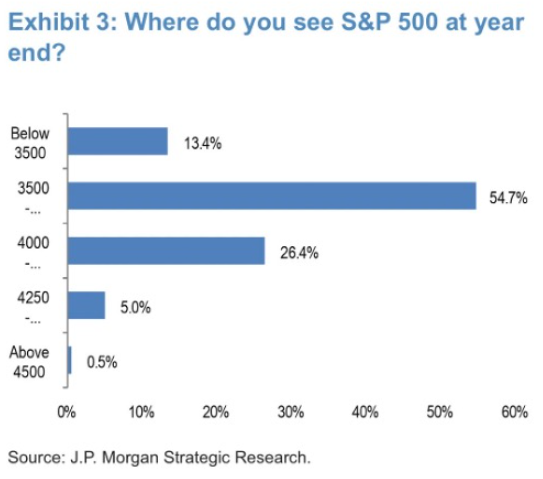

It’s earnings season – the time when publicly traded companies report on how profitable they were during the first quarter of 2023. So far, reports suggest that companies listed on United States stock exchanges did better than many had anticipated. Almost 20 percent of companies in the Standard & Poor’s 500 Index have reported and three-out-of-four have exceeded earnings expectations, per FactSet.

At any given moment, earnings expectations reflect everything that’s happening in the world, from the economy and the Federal Reserve to interest rates and geopolitics. Right now, most of the fear stems from expectations about the economy. The Fed has lifted interest rates to tamp down inflation by reducing economic demand, and so far, that seems to be working. The rate of inflation has been cut almost in half from its post-COVID peak, but growth is slowing with it...And since higher rates operate with a lag, the full effects of the rate hikes probably haven’t been felt yet, raising the possibility of a recession.

Jacob Sonenshine, Barron’s

Banks were among the first companies to report earnings, and the news reassured investors who were concerned about financial stability after the collapse of three regional banks. Despite contributing $30 billion to bailout a regional bank, big U.S. banks generally reported healthy results and higher interest income in the first quarter, reported Max Reyes of Bloomberg.

Banks still face significant challenges. Loan delinquencies have been rising from historic lows as pandemic policies have come to an end. The four largest lenders in the United States saw a 73 percent increase in consumer loan defaults and have significantly increased the assets set aside to cover loan losses.

Stocks have had a mixed start to 2023, and the economy continues to surprise many despite higher interest rates. Internationally, China is showing improvement. If one of the world’s largest economies is quickly advancing, what does that do for the odds of a U.S. recession?

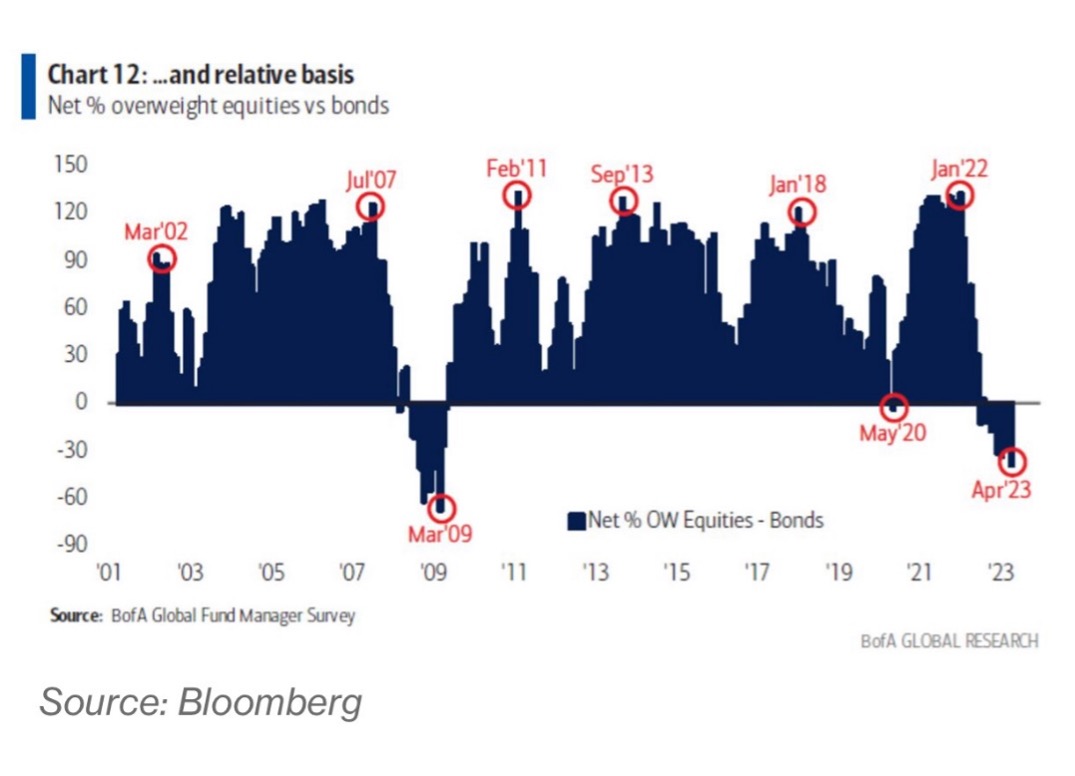

What’s fascinating is various signs of sentiment are showing over-the-top negativity. From a contrarian point of view, this type of negativity could be viewed as bullish.

Here are a couple signs that suggest investors are overly pessimistic, which could prove positive for stocks.

This negativity is rubbing off on Americans. A CNBC survey showed public pessimism on the economy hit a new high recently. According to the latest CNBC All-American Economic Survey, 69% of those surveyed held negative views about the economy now and in the future, the most pessimistic levels ever. Just 24% said it was a good time to invest in stocks, the lowest in the 17-year history of the survey.

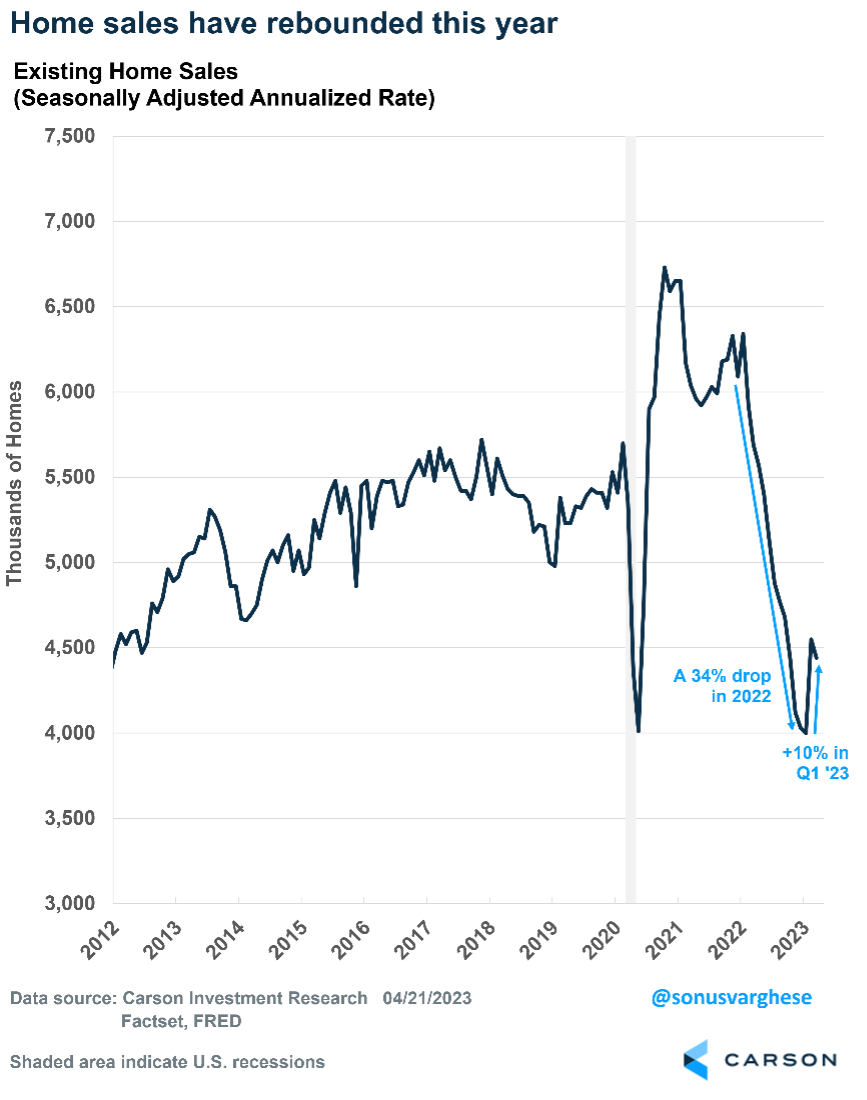

Housing was the biggest drag on economic growth last year. The economy grew by 2.1% in 2022, but that overcame a 0.93%-point drag from residential investment, i.e., housing. In fact, it’s been a drag on GDP growth for seven straight quarters, through the end of 2022. It got worse over the last three quarters of 2022 as mortgage rates surged from below 3% to just above 7%, thanks to an aggressive Federal Reserve. Housing is likely to have been a drag for the eighth quarter in a row in the first quarter of 2023.

People Want Houses, But Inventory is Low

Existing home sales fell 34% in 2022 but are up 10% over the first three months of this year. Some of that is because mortgage rates have pulled back from the peak level of 7%+ last fall. However, rates are still high, and they are significantly higher than a year ago when 30-year mortgage rates were around 3%.

In fact, based on the median price of an existing home, and assuming a 20% down payment, monthly mortgage payments have jumped from about $1,200 at the end of 2021 to $1,900 as of March. That’s not because of an increase in home prices — the median price increased about 5% to $376,000 during this period. It’s because the 30-year mortgage rate jumped from about 3.1% in December 2021 to 6.5% in March 2023! In short, affordability is low.

Nevertheless, as rebounding home sales have shown, there’s still pent-up demand. A big factor is the population of 25-34 year olds, which is prime homebuying age, is at record highs. For perspective, the number of potential first-time homebuyers is up from 39.5 million in 2006 to 46.1 million today. Pent-up demand was evident in the latest existing home sales report. Properties typically remained on the market for 29 days in March, and 65% of homes sold in March were on the market for less than a month. So, demand is clearly strong despite high mortgage rates.

The problem is there are not many homes for sale. Inventory of existing homes is currently at 2.6 months of supply at the current sales pace, which is well below a normal range of 4-6 months.

You can probably guess some of the reasons why inventory is low. First, many homeowners are “locked-in” to their homes since they got their existing mortgages at ultra-low rates. As a percentage of disposable income, mortgage debt service payments were just 4% at the end of 2022. That’s lower than it was pre-pandemic and lower than at any point during the last four economic expansions. This is great from a consumption point of view, since it means households are less financially constrained. However, it also means a lot of homeowners are unlikely to move. Who would want to sell their low-rate mortgage and buy a new home at 6.5%? The second reason, as a country we have not built enough new homes to meet population growth. This has been the case ever since the 2007 financial crisis.

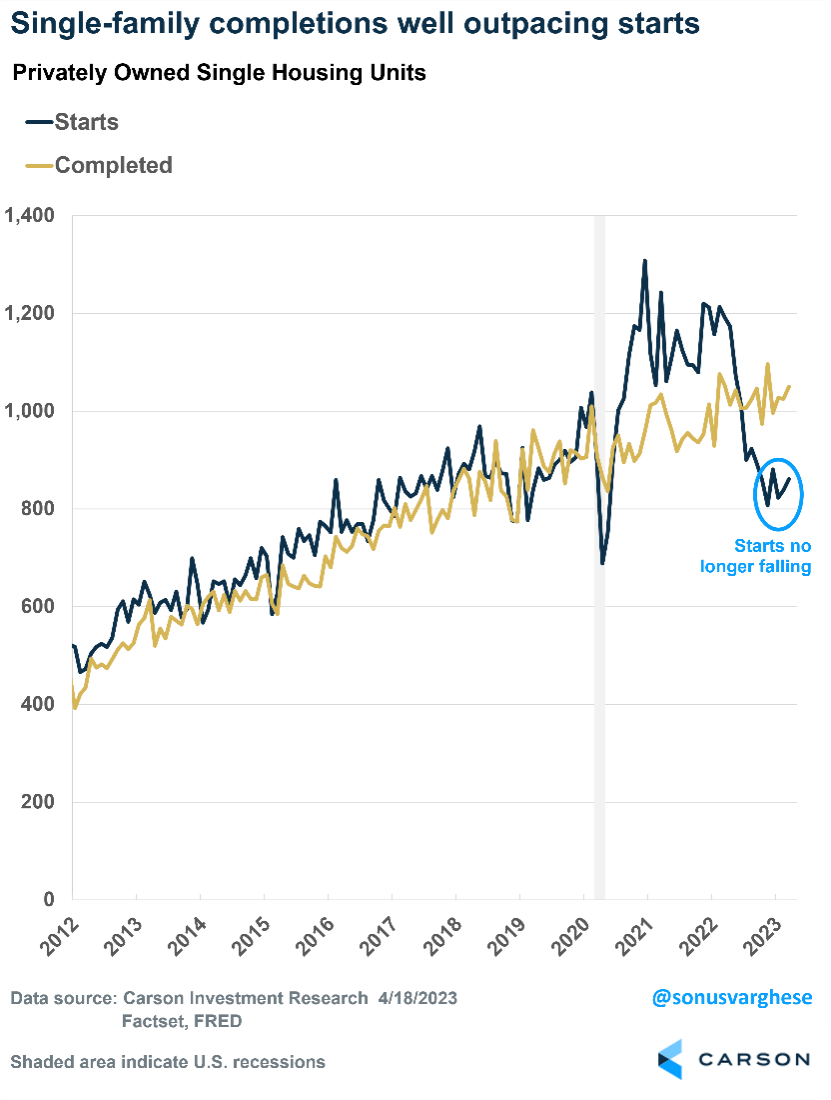

New Buyers Pushed to New Homes

Of course, those who must move have little choice but to buy a house. And if there’s not much inventory in the existing home market, they will look for new houses. That is why new home sales are up 16% from last September through February. There’s relatively more inventory in this market, about eight months of supply at the current sales pace. However, on an absolute basis, the inventory of new homes is under 450,000 — less than half that of existing homes, which is close to 1 million.

The inventory of completed homes is rising while the number of homes under construction is falling, as supply-chain issues fade. Homebuilders are also starting fewer homes than they are completing. This is not a problem now but does mean supply next year is likely to be constrained. The good news is new housing starts may have bottomed — starts are up 7% over the past five months through March.

Homebuilders are Feeling Good, and the Market is Responding

Combine the pent-up demand with relatively low supply, and builders are feeling good, as witnessed by a rebound in homebuilders’ confidence.

The market is sensing this conviction.

More activity in the new home market is even better for GDP growth. It involves activities such as design and construction, as well as large household appliance purchases, which is not the case for existing homes.

Single-family home construction makes up almost 40% of residential activity within GDP. And over the last three quarters of 2022, it crashed 23%, which is why housing was such a big drag on GDP last year.

The good news is we may have seen the back of that, with single-family construction no longer sinking. That by itself would be a positive for the economy. Any rebound, if it happens, will be even better.

In recent years, storms have led to lengthy power outages in many parts of the United States. When ice storms knocked out the Texas power grid in the winter of 2021, some people relied on generators to supply their energy needs. Others turned to hybrid trucks, reported Paul Eisenstein of NBC News.

One hybrid truck owner in Texas purchased the optional generator feature, thinking he would use it when camping or to fire up power tools in remote areas. Instead, after the storm hit, he hooked the vehicle up to his house. For three days, it “provided enough energy to handle a refrigerator, a freezer, lights, the cable and internet box and a television.”

When the supply of generators ran low, one U.S. truck manufacturer asked its Texas dealerships to lend any hybrid trucks they had in stock to people who needed power.

Hybrid trucks that double as generators is just one example of innovation in the auto industry.

The $4 trillion automotive industry is going through three big transformational changes at once. Two of those – the rise of electric vehicles and the gradual emergence of autonomous driving – have attracted most of the attention. But the third one could be more powerful still: Cars are becoming computers on wheels.

Eric Savitz, Barron’s

There are more lines of code in automobiles than there are in jumbo jets, according to a C-suite executive at a semiconductor firm who was cited by Barron’s. In fact, automakers have been scooping up workers laid off by technology companies to help develop branded software.

Not too far in the future, it’s possible that drivers will be loyal to vehicle brands in the way they are to mobile phone brands. When drivers change brands, they’ll have to learn a new system – and that could give industry leaders a competitive advantage.

If you are a resident of Montgomery County, Maryland, use the link below to determine if you are eligible to receive the Homestead Tax Credit. Per the Montgomery County Department of Finance, over 85,000 properties do not currently have a Homestead application on file and are at risk of losing the credit.

https://www.montgomerycountymd.gov/Finance/homestead.html

You can also check the Real Property Database to find out if you have already filed the application. The status of your Homestead application is located at the bottom of your real property’s page.

https://sdat.dat.maryland.gov/RealProperty/Pages/default.aspx

The Homestead Tax Credit Eligibility Application is needed to ensure that homeowners receive the Homestead credit only on their principal residence.

You are not required to reapply for the Homestead Tax Credit to retain the Montgomery County Income Tax Offset Credit ahead of the May 1 filing deadline. An 'Approved' or 'Application Received' status next to the Homestead Tax Credit Status line on your property's page means that no further action is required. Please be mindful that the Homeowners' Tax Credit is not the same as the Homestead Tax Credit and a 'No Application' status on the Homeowners' Tax Credit Application Status line does not affect the status of your Homestead Tax Credit application.

If you have questions, please contact us.

April 25, 1974: NFL Adopts Overtime for Regular-Season Games

On April 25, 1974, the NFL adopted a new overtime rule for regular-season games to prevent tie games. The rule change came as part of sweeping effort to improve the action and tempo of games. At the same time, the league also moved goal posts from the front to the back of the end zone and limited contact defensive players can make with receivers.

The new overtime rule mandated teams play an extra period if the score was tied at the end of regulation play. In overtime, the first team to score was declared the winner. If the score was still tied after the overtime, the game resulted in a tie. The NFL has since modified the overtime rules.

The season before the overtime rule was adopted, the NFL had seven ties in the regular season. Unlike some changes in NFL rules, the adoption of overtime was beneficial. From 1920 to 1973, the league had 256 ties. Since the 1974 rule change, ties have decreased significantly.

There is a difference between being resigned to a situation and reconciled to it.

Amor Towles, Novelist

Imagination is more important than knowledge. Knowledge is limited. Imagination encircles the world.

Albert Einstein, Theoretical Physicist

Investment advisory services offered through SPC Financial® (SPC). *Tax services and analysis are provided by the related firm, Sella & Martinic (S&M), through a separate engagement letter with clients. SPC and S&M do not accept orders and/or instructions regarding your investment account by email, voicemail, fax or any alternative method. Transactional details do not supersede normal trade confirmations or statements.

Email through the Internet is not secure or confidential. SPC and S&M reserve the right to monitor all email. Any information provided in this message has been prepared from sources believed to be reliable, but is not guaranteed by SPC or S&M, their owners or employees, and is not a complete summary or statement of all available data necessary for making a financial decision.

Any information provided is for informational purposes only and does not constitute a recommendation. SPC and S&M, including their owners or employees may own securities mentioned in this email or options, rights, or warrants to purchase or sell these securities.

SPC does not provide tax or legal advice. Before making a legal, investment, or tax decision, contact the appropriate professional. Any tax information or advice contained in this message is confidential and subject to the Accountant/Client Privilege.

This email is intended only for the person or entity to which it is addressed and may contain confidential and/or privileged material. Any review, retransmission, dissemination, or other use of, or taking of any action in reliance upon, this information by persons or entities other than the intended recipient is prohibited. If you received this message in error, please notify the sender and delete the material from your computer immediately. SPC and S&M shall not be liable for the improper or incomplete transmission of the information contained in this communication or for any delay in its receipt or damage to your system.

Portions of this newsletter were prepared by Carson Group Coaching. Carson Group Coaching is not affiliated with SPC or S&M. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. This information is not intended as a solicitation of an offer to buy, hold, or sell any security referred to herein. There is no assurance any of the trends mentioned will continue in the future.

Any expression of opinion is as of this date and is subject to change without notice. Opinions expressed are not intended as investment advice or to predict future performance. Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful. Past performance does not guarantee future results. Investing involves risk, including loss of principal. Consult your financial professional before making any investment decision. Stock investing involves risk including loss of principal. Diversification and asset allocation do not ensure a profit or guarantee against loss. There is no assurance that any investment strategy will be successful.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. The Dow Jones Industrial Average (DJIA), commonly known as "The Dow" is an index used to measure the daily stock price movements of 30 large, publicly owned U.S. companies. The NASDAQ composite is an unmanaged index of securities traded on the NASDAQ system.

The MSCI ACWI (All Country World Index) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. As of June 2007, the MSCI ACWI consisted of 48 country indices comprising 23 developed and 25 emerging market country indices. Bond prices and yields are subject to change based upon market conditions and availability. If bonds are sold prior to maturity, you may receive more or less than your initial investment. There is an inverse relationship between interest rate movements and fixed income prices. Generally, when interest rates rise, fixed income prices fall and when interest rates fall, fixed income prices rise.

The Bloomberg Barclays US Aggregate Bond Index is a market capitalization-weighted index, meaning the securities in the index are weighted according to the market size of each bond type. Most U.S. traded investment grade bonds are represented.

Please note, direct investment in any index is not possible. Sector investments are companies engaged in business related to a specific sector. They are subject to fierce competition and their products and services may be subject to rapid obsolescence. There are additional risks associated with investing in an individual sector, including limited diversification.

Third-party links are being provided for informational purposes only. SPC and S&M are not affiliated with and do not endorse, authorize, sponsor, verify or monitor any of the listed websites or their respective sponsors, and they are not responsible or liable for the content of any website, or the collection or use of information regarding any website's users and/or members. Links are believed to be accurate at time of dissemination, but we make no guarantee, expressed or implied, to the accuracy of the links subsequently.

This may constitute a commercial email message under the CAN-SPAM Act of 2003. If you do not wish to receive marketing or advertising related email messages from us, please click the “unsubscribe” link within this email message. You will continue to receive emails from us related to servicing your account(s).

Sources:

https://insight.factset.com/sp-500-earnings-season-update-april-21-2023

https://www.barrons.com/articles/stock-market-barely-budges-but-earnings-season-is-going-swimmingly-4d98820?refsec=the-trader&mod=topics_the-trader

https://www.bloomberg.com/news/articles/2023-04-19/wall-street-banks-sail-through-a-quarter-of-collapsed-lenders

https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value_month=202304

https://www.history.com/this-day-in-history/nfl-overtime-rule-adopted

https://www.carsonwealth.com/insights/blog/market-commentary-is-anyone-bullish/

https://www.nbcnews.com/business/business-news/some-texans-power-through-storm-help-their-ford-pickup-tesla-n1258364

https://www.barrons.com/articles/apple-carplay-gm-future-car-8542281f?mod=hp_LEAD_1

https://www.goodreads.com/quotes/tag/innovation

Would you like these weekly financial recaps personally delivered to your email inbox? Sign up here: