Stay up-to-date.

Would you like these weekly financial recaps personally delivered to your email inbox? Sign up here:

Human-Centric Wealth Management™

Current economic conditions can be interpreted in different ways, too. Recent economic data and a possible credit crunch, resulting from upheaval in the banking sector, suggest growth is slowing. After viewing the data, some say we’re heading for a soft landing, and others say a recession is coming. Here is the recent data:

The solid employment report for March further raises the odds that the U.S. economy is headed for a proverbial soft landing. Not everyone agrees.

Randall Forsyth, Barron’s

Economist and former Treasury Secretary Lawrence Summers gives more weight to manufacturing and services data than employment data. He also pointed to the Dallas Federal Reserve’s Banking Conditions Survey, which showed lending volumes declined sharply in March.

Employment and unemployment are lagging indicators of what’s happening in the real economy…There is some substantial amount of constriction in credit. If you looked at the forward-looking numbers this week from the PMI surveys, those numbers were quite weak…Recession probabilities are going up at this point. The Fed has a very, very difficult decision ahead of it.

Treasury Secretary Lawrence Summers with David Westin, Wall Street Week

Major U.S. stock indices finished the week with mixed results, reported Carleton English of Barron’s. In the Treasury market, yields on many shorter-maturity increased, while yields on longer-maturities fell.

Stocks were relatively flat last week in the face of weak economic data. Services, manufacturing, and job openings all were weak, but the monthly jobs data (more below) was a bright spot. Still, in the face of slowing economic reports, we were impressed stocks were able to hold onto some gains.

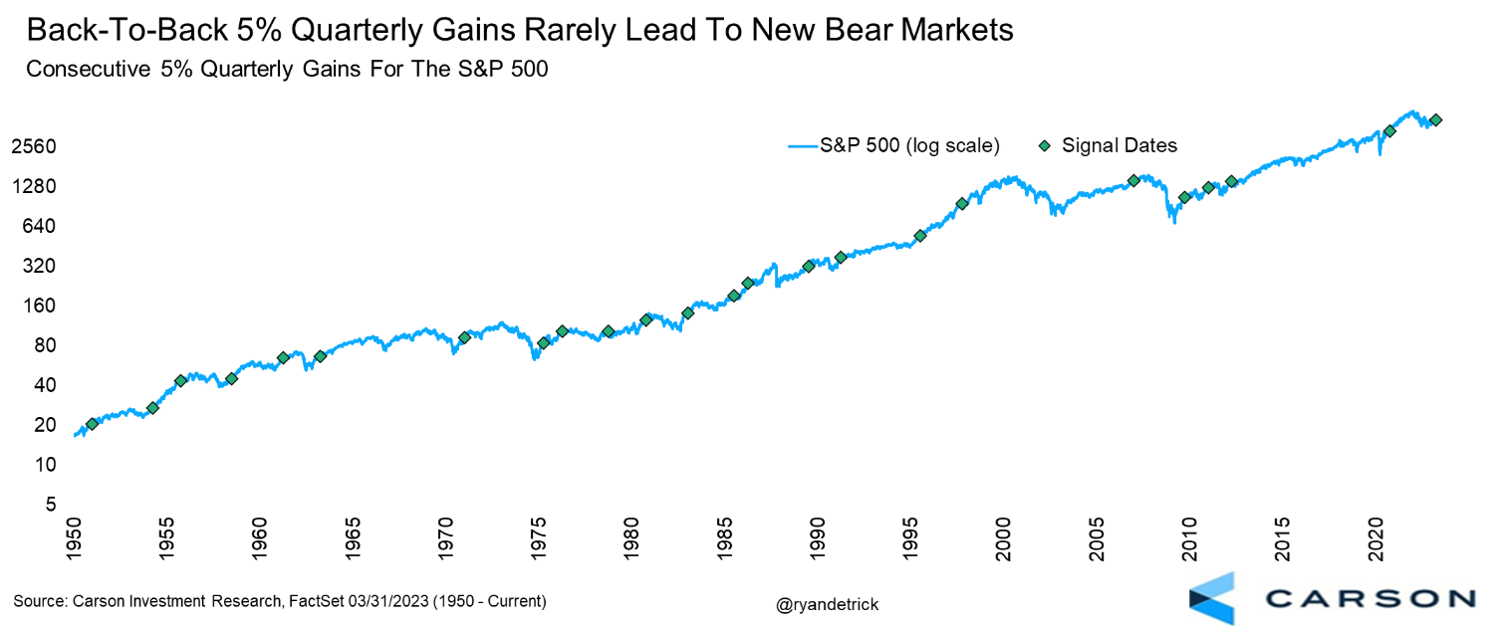

Many market watchers have been calling this a bear market rally, but history shows that consecutive 5% quarters rarely happen in the middle of bear markets. More often than not, they occur at the start of new bull markets. As the chart below shows, this rare signal suggests the potential for more strength, not the start of a new bear market. In fact, two quarters later stocks have been higher 21 out of the past 23 times after this bullish signal.

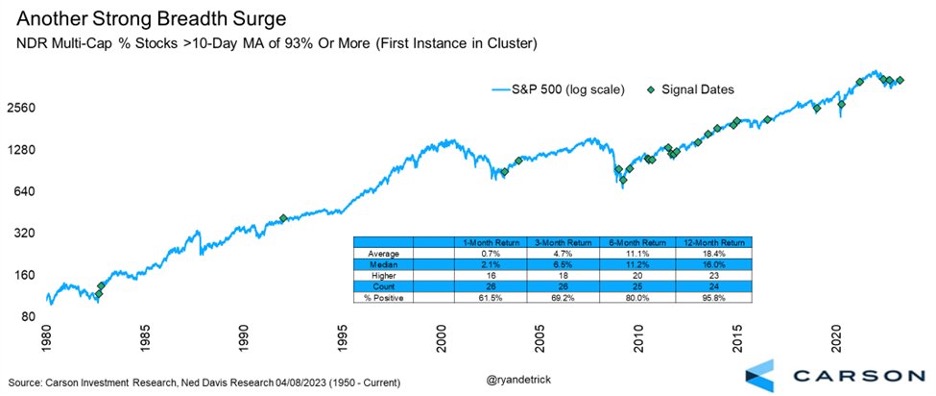

Some are raising concerns that only a few stocks are pulling the market higher, saying this indicates poor market breadth, which could signal cracks in the armor and a potential fall. However, this is not true as many stocks have been advancing.

In fact, more than 93% of all stocks tracked by Ned Davis Research recently climbed above their 10-day moving averages. This rare sign of strength has led to higher prices for the S&P 500 23 out of 24 times one year later and an average return of 18.4% on average.

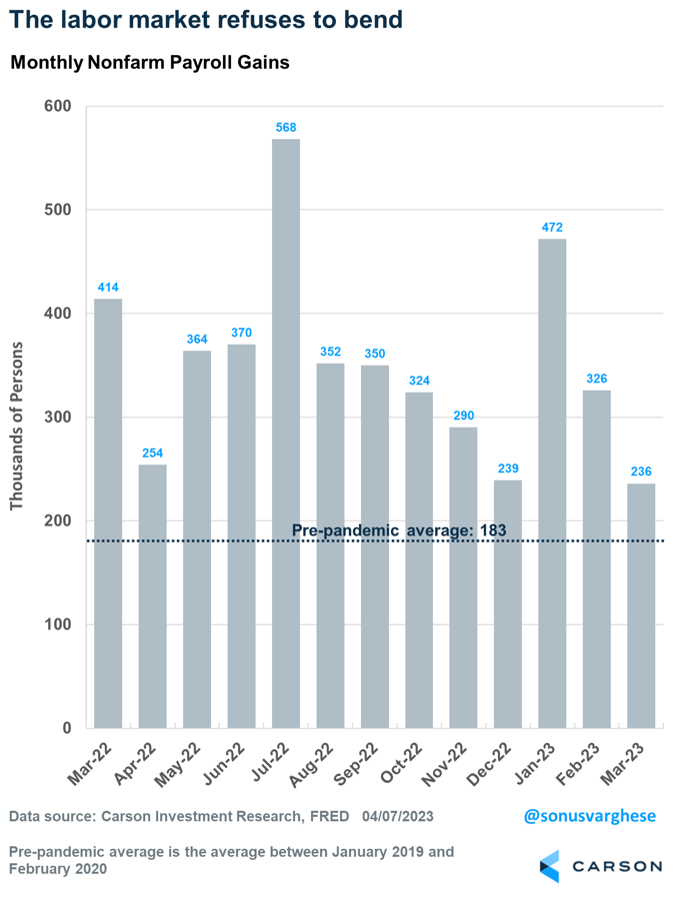

Prior to the release of the March payroll report, there were several indications that the labor market was headed for a slowdown. January and February payrolls were well above expectations, leading to concerns that the strength was due to seasonal factors that would reverse. Then Silicon Valley Bank crashed in early March, raising fears the economy would buckle if a widespread banking crisis followed.

Then, last week, the Bureau of Labor Statistics (BLS) released data that showed job openings fell below 10 million in February, the lowest level since May 2021. Despite being well above the near-7 million openings pre-pandemic, it indicated labor demand was softening. (We would like to note this is precisely what Federal Reserve officials were hoping to see.) In addition, the BLS revised all unemployment benefit claims data going back to 2018. This is typically a leading indicator for the labor market, and the news wasn’t good. Claims for unemployment benefits have been steadily rising since October — not by enough for a recession to be imminent but enough to raise concerns.

So, the March payroll release had a lot riding on it as investors and economists wondered if the data would corroborate these concerns.

Instead, we got yet another solid payroll report, with 236,000 jobs created in March. While below the 346,000 average of the prior three months, this is very strong. The economy was creating about 180,000 jobs a month prior to the pandemic and needs 100,000 or so to keep up with population growth. It is currently more than doubling that amount.

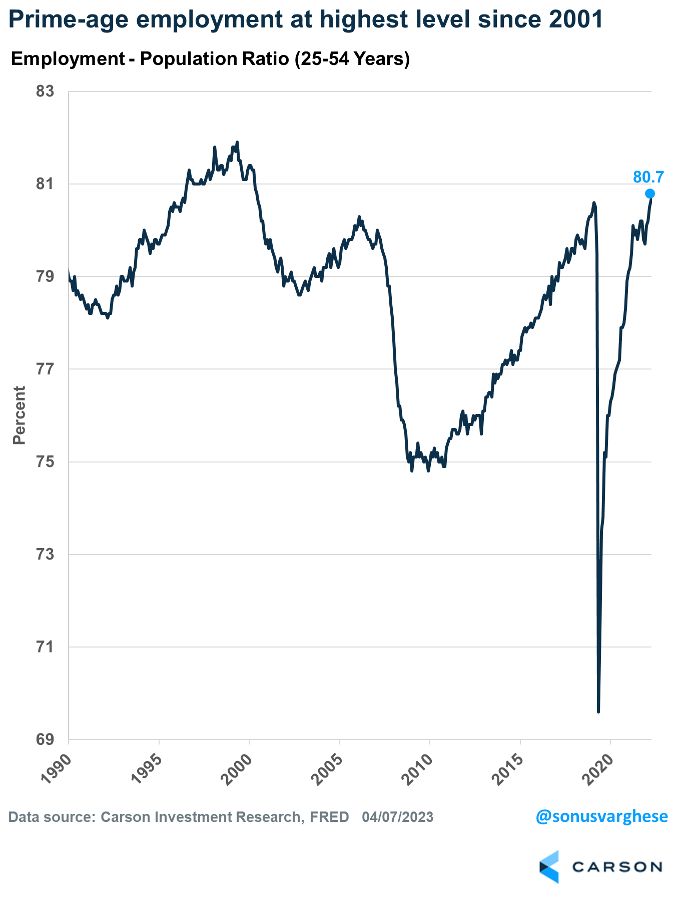

Moreover, the unemployment rate fell to 3.5% and is just a tick above its lowest rate in 50-plus years. And that happened despite almost 500,000 more people entering the labor force. This belies concerns that the labor market is “supply-constrained” and the Fed must somehow force demand lower to match supply. Instead, we have a strong job market in which employers want to continue hiring, and that is making workers and potential workers more confident to start looking for jobs.

Perhaps the best indicator is the employment-population ratio for prime-age workers (25-55 years). In a sense the opposite of unemployment, this indicator measures employment for people in their prime working years as a percentage of the civilian working-age population. It also avoids issues related to an aging population and people who the BLS considers not part of the labor force for various reasons, such as lack of childcare. The measure rose to 80.7%, which is the highest level since 2001 and a sign that this is a strong labor market.

Good News for the Fed

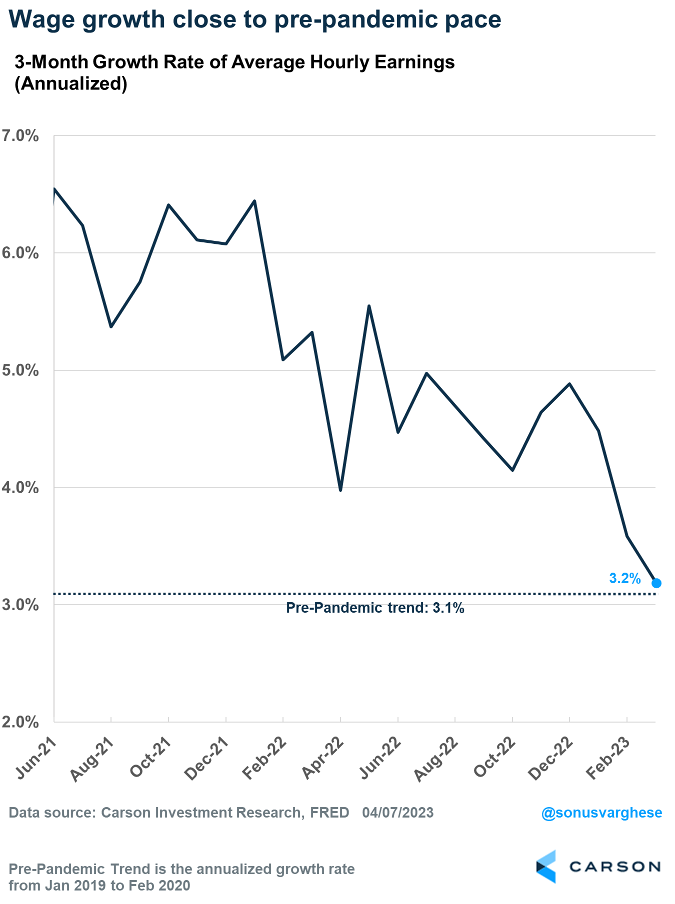

What’s most positive is the unemployment rate is near historic lows even as wage growth is decelerating. Over the past three months, average hourly earnings for private sector workers rose at an annualized pace of 3.2%, which is barely above pre-pandemic levels.

Fed officials have tied inflation, especially services excluding housing, to wage growth. Decelerating wage growth should give them enough reason to pause on further interest rate hikes, as inflation is likely to continue trending lower over the rest of 2023. Given their aggressive pace of rate hikes over the past year, and their most recent hike, which they implemented despite being within two weeks of a banking crisis, we believe there is enough justification for a pause.

We also believe the employment data implies the economy is still positioned to avoid a recession this year. That means it’s highly unlikely the Fed will cut rates, as Fed officials themselves continue to stress. However, markets are expecting the Fed to cut rates by at least 0.75% by the end of this year. So, expect some volatility in bond markets as investors’ views converge with the Fed’s.

In the 1970s, Martin Zweig cautioned investors: Don’t fight the Fed. He believed there was a correlation between Federal Reserve monetary policy and the direction of stock markets, reported Steve Sosnick of Barron’s. Here’s generally how it worked:

Ultimately, Zweig’s advice meant that investors should be more aggressive when the Fed was pursuing loose monetary policy, and more conservative when it was pursuing tight monetary policy.

Investors understood this dynamic during the recovery from the bursting of the U.S. housing bubble, buying stocks in droves while the Fed held interest rates near zero…The central bank’s loose policies helped bring about the second longest bull market in the S&P 500’s history, between Mar. 9, 2009, and the COVID-19–induced bear market of 2020…

Will Daniel, Fortune

Today, the Federal Reserve is pursuing tight monetary policy, and has indicated that lower rates are not on the table for 2023. Investors seem to think otherwise, though. The Fed raised the federal funds rate in March, but not all Treasury yields followed suit. Yields on longer-dated Treasuries moved lower, suggesting investors think rate cuts are ahead.

If you are a resident of Montgomery County, Maryland, use the link below to determine if you have filed a homestead application and are eligible to receive the tax credit.

montgomerycountymd.gov/Finance/homestead.html

Per the Montgomery County Department of Finance, over 85,000 properties do not currently have a Homestead application on file and are at risk of losing the credit.

If you have questions, please contact us.

The deadline to make 2022 contributions to your IRA or Roth IRA is April 18, 2023. The total contributions that you can make annually to these accounts cannot be more than the following:

If you have already contributed the maximum amount allowed for 2022, the total contributions that can be made in 2023 are:

If you are unsure of how much you have contributed to your IRA or Roth IRA for the year 2022, or would like assistance in opening one of these accounts, please contact us.

April 11, 1921: First Live Sporting Event Broadcast on Radio

On April 11, 1921, KDKA in Pittsburgh broadcast the first live sporting event on the radio, a boxing match between Johnny Ray and Johnny Dundee. Pittsburgh Daily Post sports editor Florent Gibson called the event, about four months before KDKA's Harold Arlin announced the first Major League Baseball game broadcast on radio.

The lightweight bout pitted Dundee, who was inducted into the International Boxing Hall of Fame in 1991, against Ray, who would later train and manage famed boxer Billy Conn. In the early part of the 20th century, radio had been used primarily for two-way communication. The medium's popularity took a nosedive during World War I, when the U.S. military took over all airwaves, but in 1920, KDKA became the first licensed radio station and put its live-event broadcasting to the test six months later.

Ray, who fought "like a master," according to the Pittsburgh Daily Post, won the 10-round fight.

Within three months, the second fight broadcast on radio took place, a title bout between heavyweight champ Jack Dempsey and Georges Carpentier.

Be fearful when others are greedy, and greedy when others are fearful.

Warren Buffett, Investor

Power without love is reckless and abusive, and love without power is sentimental and anemic.

Martin Luther King, Jr., Baptist Minister and Activist

Investment advisory services offered through SPC Financial® (SPC). *Tax services and analysis are provided by the related firm, Sella & Martinic (S&M), through a separate engagement letter with clients. SPC and S&M do not accept orders and/or instructions regarding your investment account by email, voicemail, fax or any alternative method. Transactional details do not supersede normal trade confirmations or statements.

Email through the Internet is not secure or confidential. SPC and S&M reserve the right to monitor all email. Any information provided in this message has been prepared from sources believed to be reliable, but is not guaranteed by SPC or S&M, their owners or employees, and is not a complete summary or statement of all available data necessary for making a financial decision.

Any information provided is for informational purposes only and does not constitute a recommendation. SPC and S&M, including their owners or employees may own securities mentioned in this email or options, rights, or warrants to purchase or sell these securities.

SPC does not provide tax or legal advice. Before making a legal, investment, or tax decision, contact the appropriate professional. Any tax information or advice contained in this message is confidential and subject to the Accountant/Client Privilege.

This email is intended only for the person or entity to which it is addressed and may contain confidential and/or privileged material. Any review, retransmission, dissemination, or other use of, or taking of any action in reliance upon, this information by persons or entities other than the intended recipient is prohibited. If you received this message in error, please notify the sender and delete the material from your computer immediately. SPC and S&M shall not be liable for the improper or incomplete transmission of the information contained in this communication or for any delay in its receipt or damage to your system.

Portions of this newsletter were prepared by Carson Group Coaching. Carson Group Coaching is not affiliated with SPC or S&M. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. This information is not intended as a solicitation of an offer to buy, hold, or sell any security referred to herein. There is no assurance any of the trends mentioned will continue in the future.

Any expression of opinion is as of this date and is subject to change without notice. Opinions expressed are not intended as investment advice or to predict future performance. Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful. Past performance does not guarantee future results. Investing involves risk, including loss of principal. Consult your financial professional before making any investment decision. Stock investing involves risk including loss of principal. Diversification and asset allocation do not ensure a profit or guarantee against loss. There is no assurance that any investment strategy will be successful.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. The Dow Jones Industrial Average (DJIA), commonly known as "The Dow" is an index used to measure the daily stock price movements of 30 large, publicly owned U.S. companies. The NASDAQ composite is an unmanaged index of securities traded on the NASDAQ system.

The MSCI ACWI (All Country World Index) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. As of June 2007, the MSCI ACWI consisted of 48 country indices comprising 23 developed and 25 emerging market country indices. Bond prices and yields are subject to change based upon market conditions and availability. If bonds are sold prior to maturity, you may receive more or less than your initial investment. There is an inverse relationship between interest rate movements and fixed income prices. Generally, when interest rates rise, fixed income prices fall and when interest rates fall, fixed income prices rise.

The Bloomberg Barclays US Aggregate Bond Index is a market capitalization-weighted index, meaning the securities in the index are weighted according to the market size of each bond type. Most U.S. traded investment grade bonds are represented.

Please note, direct investment in any index is not possible. Sector investments are companies engaged in business related to a specific sector. They are subject to fierce competition and their products and services may be subject to rapid obsolescence. There are additional risks associated with investing in an individual sector, including limited diversification.

Third-party links are being provided for informational purposes only. SPC and S&M are not affiliated with and do not endorse, authorize, sponsor, verify or monitor any of the listed websites or their respective sponsors, and they are not responsible or liable for the content of any website, or the collection or use of information regarding any website's users and/or members. Links are believed to be accurate at time of dissemination, but we make no guarantee, expressed or implied, to the accuracy of the links subsequently.

This may constitute a commercial email message under the CAN-SPAM Act of 2003. If you do not wish to receive marketing or advertising related email messages from us, please click the “unsubscribe” link within this email message. You will continue to receive emails from us related to servicing your account(s).

Sources:

https://en.wikipedia.org/wiki/Rubin_vase

https://www.bea.gov/sites/default/files/2023-03/pi0223.pdf

https://www.prnewswire.com/news-releases/manufacturing-pmi-at-46-3-march-2023-manufacturing-ism-report-on-business-301787309.html

https://www.prnewswire.com/news-releases/services-pmi-at-51-2-march-2023-services-ism-report-on-business-301789944.html

https://www.bls.gov/news.release/empsit.a.htm

https://www.carsonwealth.com/insights/market-commentary/market-commentary-cautiously-optimistic-on-markets/

https://www.barrons.com/articles/fed-inflation-economy-jobs-report-rate-hikes-a43e0d82

https://www.dallasfed.org/research/surveys/bcs/2023/bcs2302

https://www.history.com/this-day-in-history/historic-sports-radio-broadcasts

https://www.barrons.com/articles/stock-market-dow-nasdaq-s-p-500-fed-dividends-97aaef90?refsec=the-trader&mod=topics_the-trader

https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value=2023

https://www.barrons.com/articles/fed-interest-rates-investing-mantras-51662006600

https://www.montgomerycountymd.gov/Finance/homestead.html

https://www.imf.org/en/Publications/fandd/issues/Series/Back-to-Basics/Monetary-Policy

https://www.yahoo.com/video/don-t-fight-fed-wall-165947003.html

https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20230322.pdf

Would you like these weekly financial recaps personally delivered to your email inbox? Sign up here: